A demand letter is a formal notice sent to request assets, money, or legal action from another person as a last attempt to solve an issue without going to court. It mostly comes in handy when asking for money to cover a due debt and often acts as a last notice to the debtor.

For a demand letter to be effective, it must include language that motivates the recipient to comply with the terms of a past agreement. This could include an incentive upon action or a threat to take legal action if nothing is done within a given time-frame.

Below, we highlight everything you need to know to draft an effective demand letter.

Demand Letters: By Type (30)

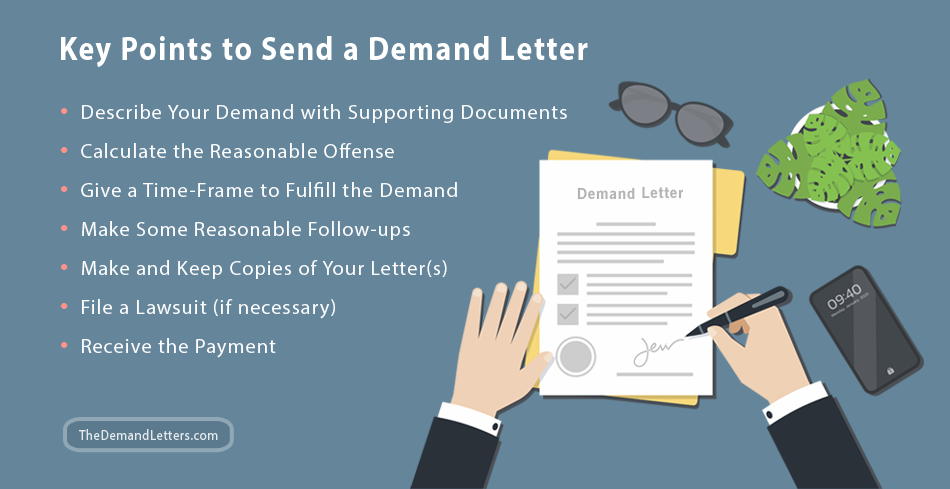

How to Write a Demand Letter

Time needed: 15 minutes.

When drafting a demand letter, it is advisable to get straight to the point. That said, you must ensure that you and the reader are on the same page by identifying yourself and the recipient by name, including the date, and mentioning your reason for writing. You can then do the following:

- Describe Your Demand

Why are you writing this demand letter? Use the first paragraph to explain to the reader the nature of your demand, and include as many details as possible. This includes dates and amounts.

- Provide Supporting Evidence

This is where you convince the reader that your demand is valid by providing supporting evidence. If you are requesting payment, you should mention and attach invoices, receipts, and purchase orders. You can also mention your previous attempts to collect the payment and the reader’s responses to them.

- Give a Time-frame for the Resolution

When would you like the reader to rectify the problem? Always provide an exact timeframe, including a date, within which the reader can act on your demand. In this segment, it is crucial that you leave nothing to interpretation.

- Provide an Alternative

You should always consider the possibility that the conflict may not be resolved within the given timeframe. Should this happen, what can the reader do to ensure immediate resolution. One option, for example, is to ask a debtor to contact you to discuss payment.

- Affirm the Consequences of Non-Compliance

What will you do if the reader disregards your demand? Lastly, a demand letter is incomplete without consequences for non-compliance. This section acts as an incentive to the reader to act promptly.

How Long Do Settlements Take?

Writing a demand letter is a crucial first step toward a settlement, but it is only the first step. The exact time it will take to resolve your claim will usually vary, depending on the facts of your case. For example, if your claim involves collecting nine signatures, it may take longer than a case that only requires two.

How to Write a Demand Letter (Video)

Money Owed vs Breach of Contract

There are two main types of demand letters: money owed and breach of contract letters. The former only deals with matters of unpaid balances, while the breach of contract demand letter covers contract violations. Despite this fundamental difference, however, both demand letters are drafted using the same format. They:

- Explain the problem

- Provide an acceptable solution

- Give a timeframe for the solution

- Mention the consequences of non-compliance

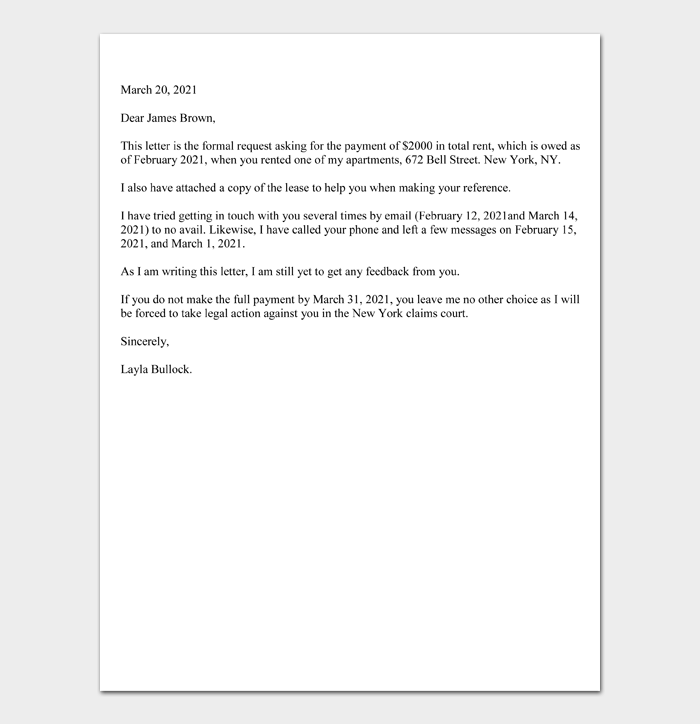

Eviction Notice

A demand letter for rent is sometimes called an eviction notice, especially when previous such letters have been sent to the tenant with no results. The landlord, who is the sender, provides the tenant or recipient with a specified number of days to pay the due rent. If they don’t, they will be required to vacate the premises. Drafting a demand letter for rent is a delicate process as every state has policies on the amount of notice a landlord should give a tenant before evicting them.

Benefits of a Demand Letter

Sending a demand letter is not a legal requirement in some states, which can make you question its benefits. All facts considered, however, a demand letter is essential to your claim for the following reasons:

- A demand letter promotes settlement since it convinces the debtor that your claim is not going away. In fact, demand letters have been shown to do this in close to one-third of all disputes.

- Drafting the letter gives you a closer look at every aspect of your case, including the evidence, circumstances, and laws related to it. This helps you organize your case should you need to sue.

Small Claims Amounts: By State

While the small claims limit will vary from state to state, it often ranges between $5,000 and $10,000. The following are the maximum allowable amounts in different small claims courts, listed by state:

- Alabama – $6,000 (§ 12-12-31)

- Alaska – $10,000 (§ 22.15.040)

- Arizona – $3,500 (§ 22-503)

- Arkansas – $5,000 (Guide)

- California – $10,000* (§ 116.210-116.270)

- Colorado – $7,500 (§ 13-6-403)

- Connecticut – $5,000 (§ 51-15(d))

- Delaware – $15,000 (§ 9301)

- Florida – $8,000 (Rule 7.010(b))

- Georgia – $15,000* (§ 15-10-2)

- Hawaii – $5,000* (§633-27, Guide)

- Idaho – $5,000 (§ 1-2208(1)(a))

- Illinois – $10,000 (Rule 281)

- Indiana – $6,000/$8,000 (Rules, Guide, § 33-34)

- Iowa – $6,500 (§ 631.1)

- Kansas – $4,000 (§ 61-2703(a))

- Kentucky – $2,500 (§ 24A.230)

- Louisiana – $5,000 (§ 5202)

- Maine – $6,000 (§ 7482, Guide)

- Maryland – $5,000 (§ 4-405)

- Massachusetts – $7,000 (§ 218-21)

- Michigan – $6,000 (§ 600.8401)

- Minnesota – $15,000 (§ 491A.01)

- Mississippi – $3,500 (§ 9-11-9)

- Missouri – $5,000 (Guide)

- Montana – $7,000 (§ 25-35-502)

- Nebraska – $3,600 (§ 25-2802, Small Claims)

- Nevada – $10,000 (§ 73.010)

- New Hampshire – $10,000 (§503-1)

- New Jersey – $3,000 (Guide)

- New Mexico – $10,000 (§ 34-8a-3)

- New York – $5,000 (§ 1801, Guide)

- North Carolina – $10,000 (§ 7A-210)

- North Dakota – $15,000 (§ 27-08.1-01)

- Ohio – $6,000 (§ 1925.02(A)(1))

- Oklahoma – $10,000 (§ 1751)

- Oregon – $10,000 (§ 55.011-55.140)

- Pennsylvania – $12,000 (State Guide/Philadelphia)

- Rhode Island – $2,500 (§ 10-16-1)

- South Carolina – $7,500 (§ 22-3-10)

- South Dakota – $12,000 (§ 15-39-45.1)

- Tennessee – $25,000 (§ 16-15-501(d))

- Texas – $10,000 (§ 26.042)

- Utah – $11,000 (§ 78A-8-102)

- Vermont – $5,000 (Guide)

- Virginia – $5,000 (§ 16.1-122.2)

- Washington – $5,000 (§ 12.40.010)

- West Virginia – $10,000 (§ 50-2-1)

- Wisconsin – $10,000 (§ 799.01(d))

- Wyoming – $6,000 (§ 1-21-201, Rules)

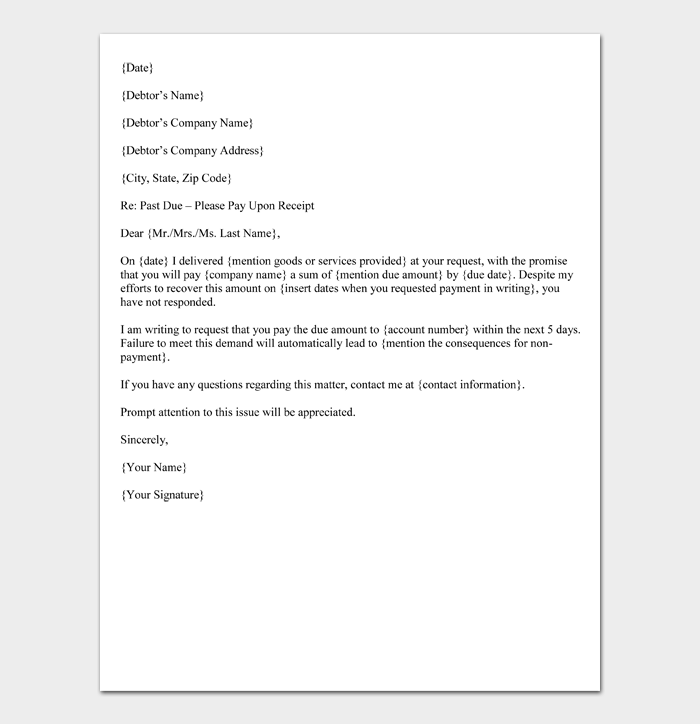

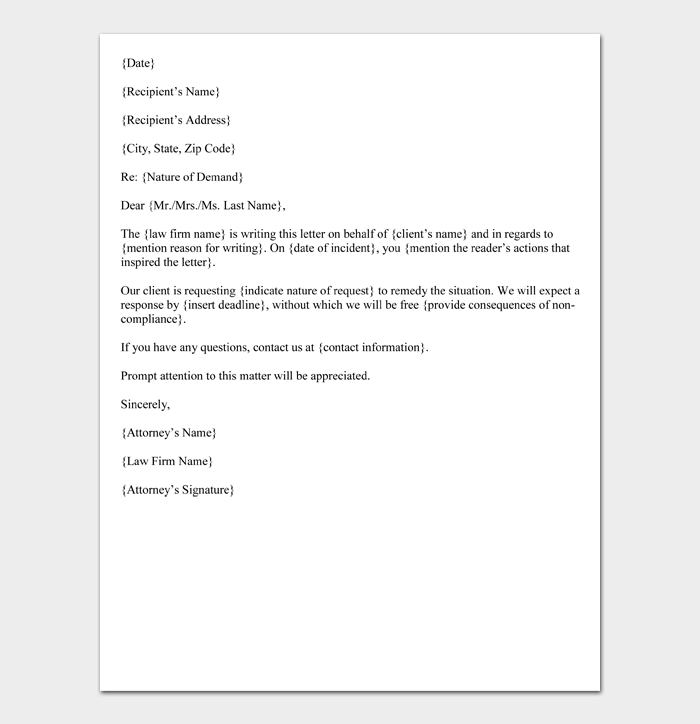

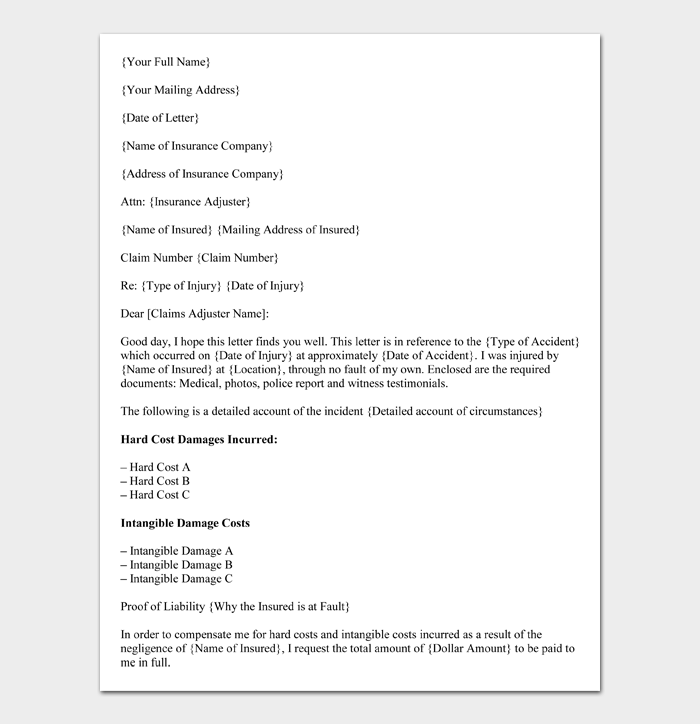

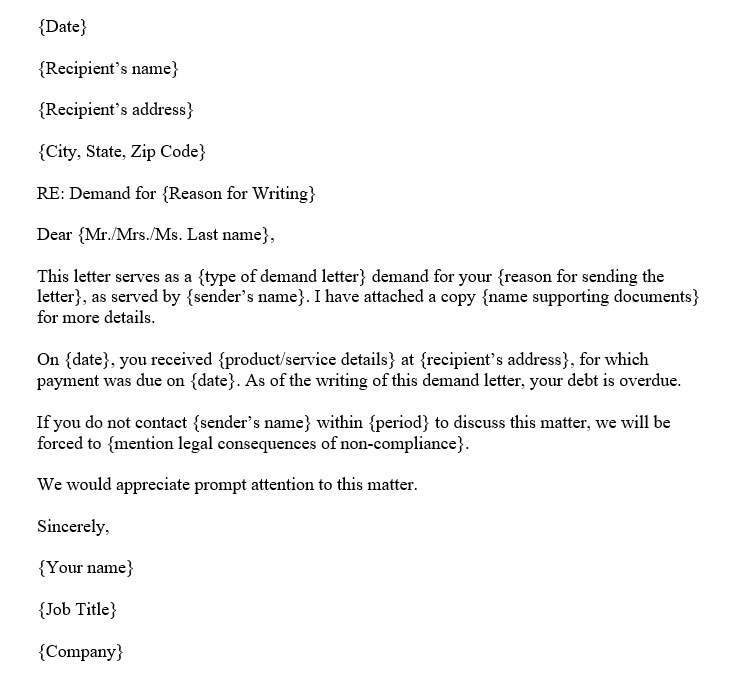

Demand Letter Format

{Date}

{Recipient’s name}

{Recipient’s address}

{City, State, Zip Code}

RE: Demand for {Reason for Writing}

Dear {Mr./Mrs./Ms. Last name},

This letter serves as a {type of demand letter} demand for your {reason for sending the letter}, as served by {sender’s name}. I have attached a copy {name supporting documents} for more details.

On {date}, you received {product/service details} at {recipient’s address}, for which payment was due on {date}. As of the writing of this demand letter, your debt is overdue.

If you do not contact {sender’s name} within {period} to discuss this matter, we will be forced to {mention legal consequences of non-compliance}.

We would appreciate prompt attention to this matter.

Sincerely,

{Your name}

{Job Title}

{Company}

Sample Demand Letter for Payment

21 February 2031

Milton Galecki

Price Motor Industries

200 Owl Street

New York City, NY 68308

Re: Demand for Payment of Outstanding Fees

Dear Mr. Galecki,

Please consider this letter as an official demand for payment for the amount of $4,000 owed to O’Neill repair shop. On 1 February 2031, you placed an order at my shop for the repair of three use cars, with the promise that you would pay $9,000 beforehand, and the rest after delivery. I have not received this amount despite having delivered your cars two weeks ago.

I have attached a copy of your invoice to this letter. If you do not clear the balance or contact me by 28 February 2031, I am prepared to take legal action against your company.

Prompt attention to this matter would be appreciated.

Sincerely,

Lilian O’Neil

Sample Breach of Contract Letter

21 February 2031

Patricia Watkins

Watkins International

009 Yonder Road

Fort Worth, TX 70790

Re: Breach of Contract, 009/WI/2030

Dear Mrs. Watkins,

On 3 December 2030, you entered into a contract with Barnett Repairs for the repair and replacement of roofs in three Watkins International branch locations. While my records show that the work has been completed, your company is yet to finalize the payment for services rendered. This puts you in breach of the contract.

As of the writing of this letter, you owe Barnett Repairs a total of $10,504. Please contact our office immediately at barnettrepairs@email.com to arrange payment.

Please note that I am ready to explore any and all legal options available to me to recover this amount if I do not hear from you by 1 March 2031.

Sincerely,

Kimberly Barnett

Sample Demand Letter from an Attorney

21 February 2031

Timothy Griffin

ACC Industries

700 Freestate County Road

Chicago, IL 0990

Re: Demand for Payment of Services

Dear Mr. Griffin,

I am writing this letter on behalf of my client, Mr. Robert Park, to whom you owe a payment of $149,000. On 1 February 2031, Mr. Park supplied and installed your company with 400 PC pipes and 5 300-metre long electric cables at your request. You have since not paid him or contacted him to discuss compensation.

As the main practitioner at Danielle and Associates, LLC, I hereby request that you compensate Mr. Park in full for the services rendered. Please note that my law firm will take immediate legal action if you do not comply by1 March 2031.

Sincerely,

Jennifer Danielle

Danielle and Associates, LLC

Demand Letter Templates & Examples

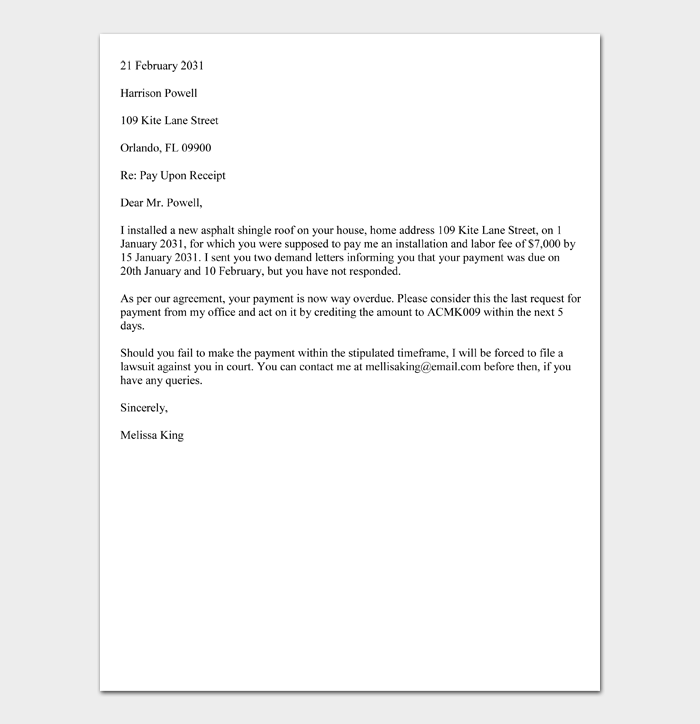

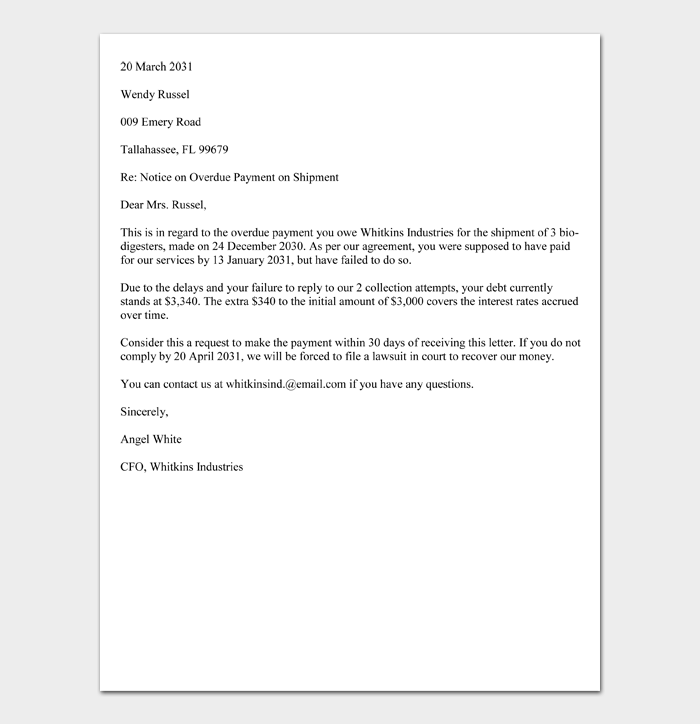

5-Day Demand Letter for Payment

A 5-day demand letter for payment is an official notice sent to a debtor as a final request to pay a due debt in 5 days before legal action is taken. It is often only used when you have sent the debtor multiple reminders about the debt in the past with no results.

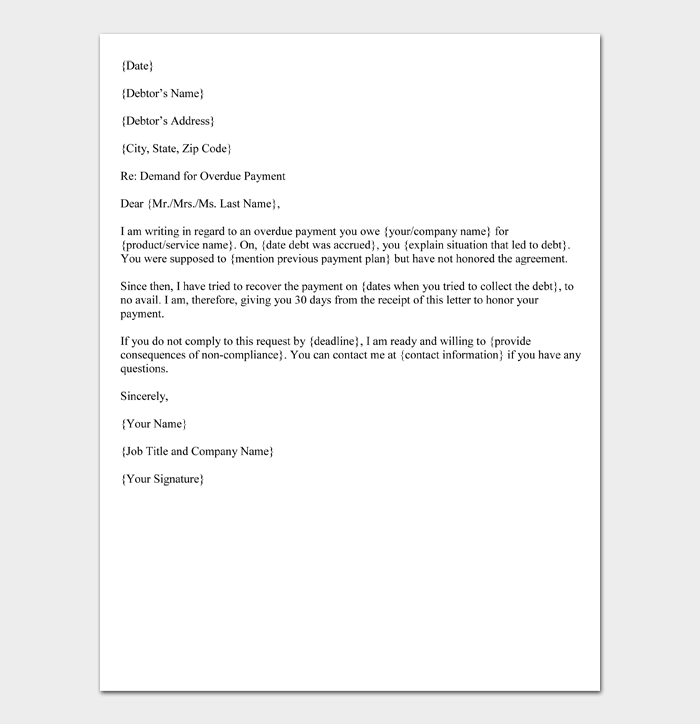

10-Day Demand Letter for Payment

A 10-day demand letter for payment is an official request sent to a debtor to give them 10 days to cure their debt or obligation. It is an essential first step towards resolving a dispute involving unpaid money and carries a friendlier tone than subsequent demand letters.

15-Day Demand Letter for Payment

A 15-day demand letter for payment is a formal request sent to a debtor to request that they settle their debt. Besides its use in getting a debtor to cure their unpaid financial obligation, it can also be used as evidence in a lawsuit.

30-Day Demand Letter for Payment

A 30-day demand letter for payment is an official notice served to an individual or company when their payment or debt is due. It gives the recipient 30 days to cure the debt, failure to which the sender can take legal action against them.

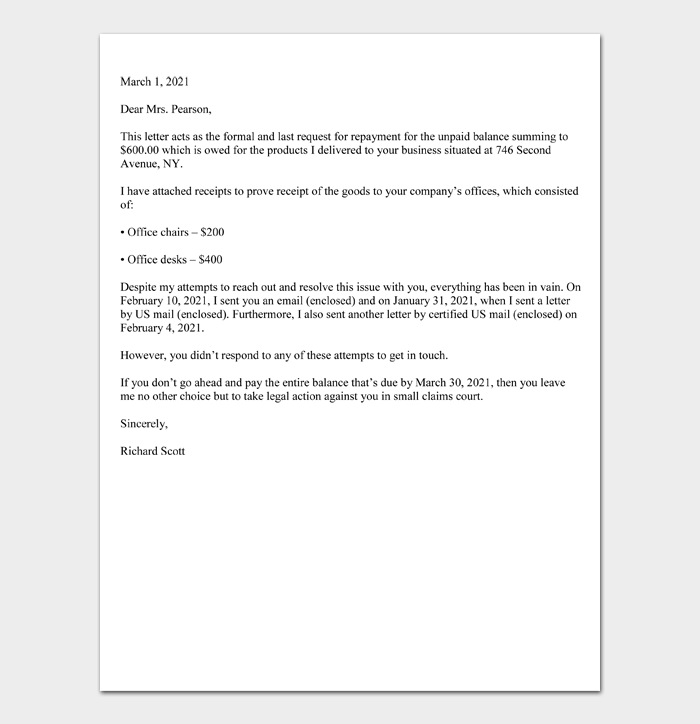

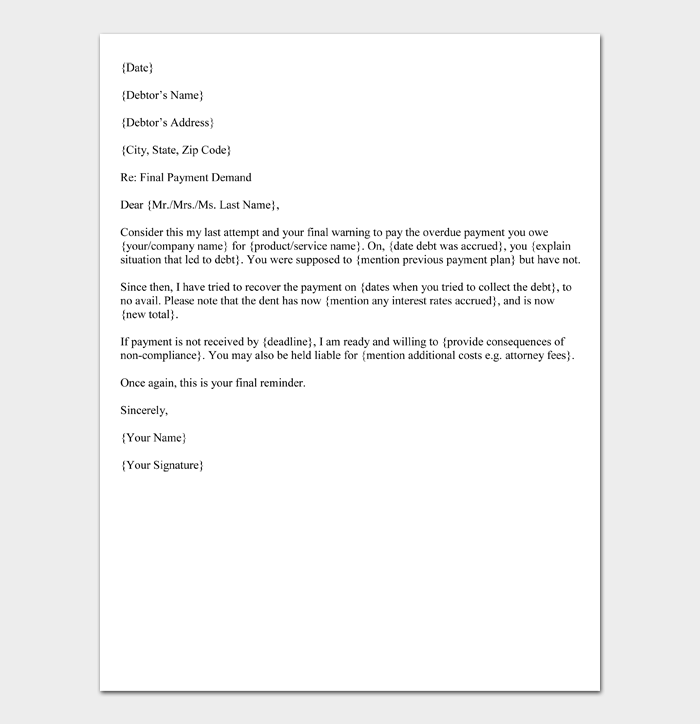

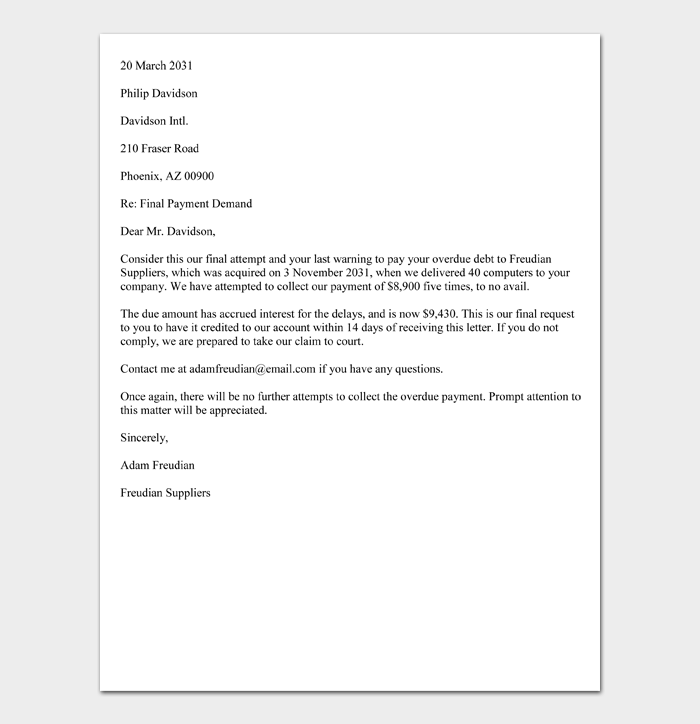

Final Demand Letter for Payment

A final demand letter for payment is the last official notice sent to collect a debt or request payment. It often signifies the last attempt by the sender to resolve a matter of unpaid money before taking legal action against the debtor.

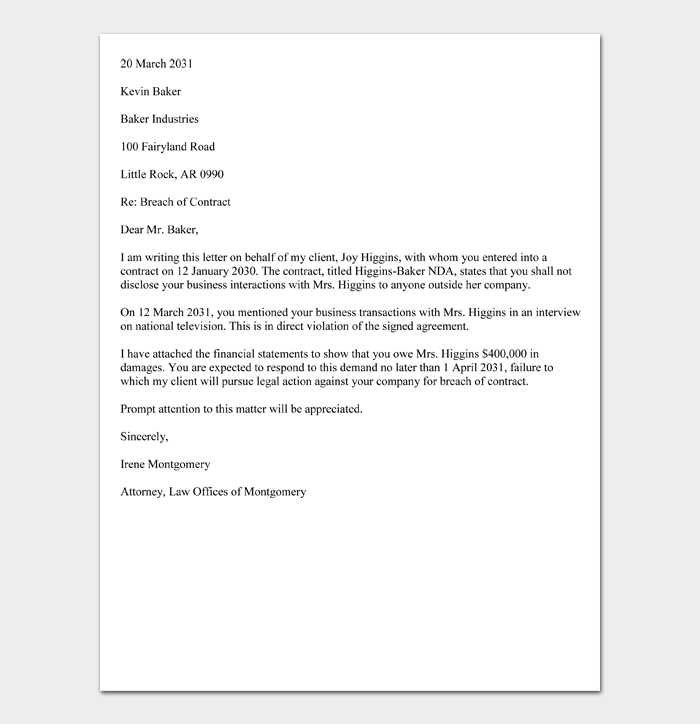

Demand Letter from Attorney

A demand letter from attorney is a formal notice sent by a lawyer on behalf of their client to request action or demand payment. It outlines the exact reason the attorney is writing, who they are representing, and the action they might take if the letter is ignored.

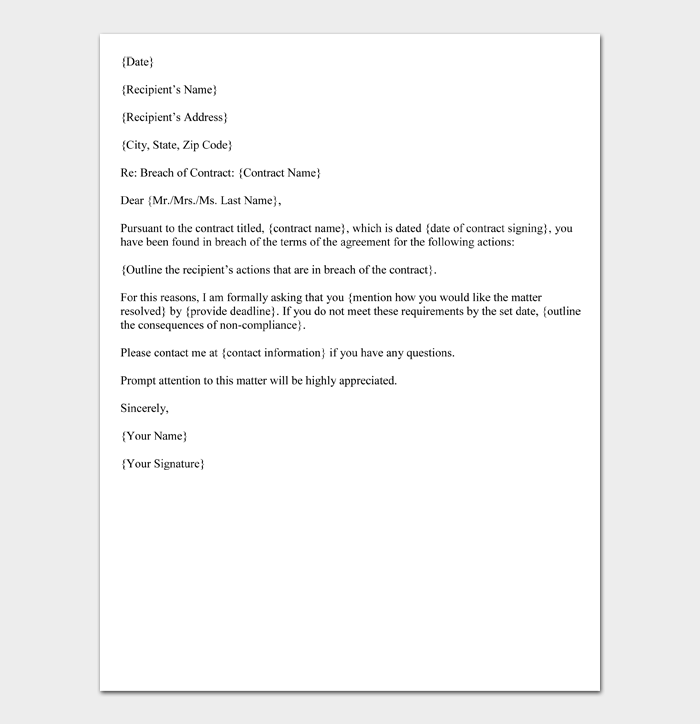

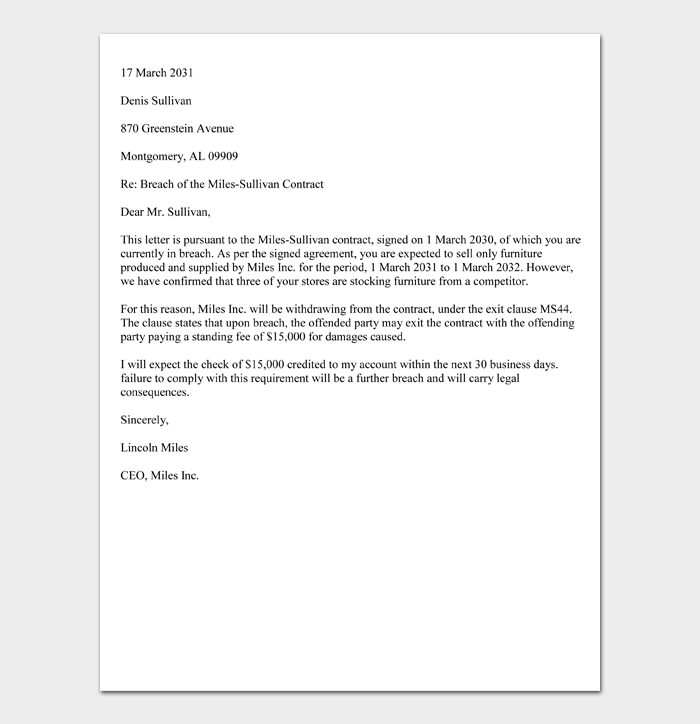

Breach of Contract Demand Letter

A breach of contract demand letter is a formal notice sent to an individual or company that has failed to act as indicated in a previously signed contract. It usually highlights details of the contract, how the recipient breached the terms, and the course of action the sender would like taken.

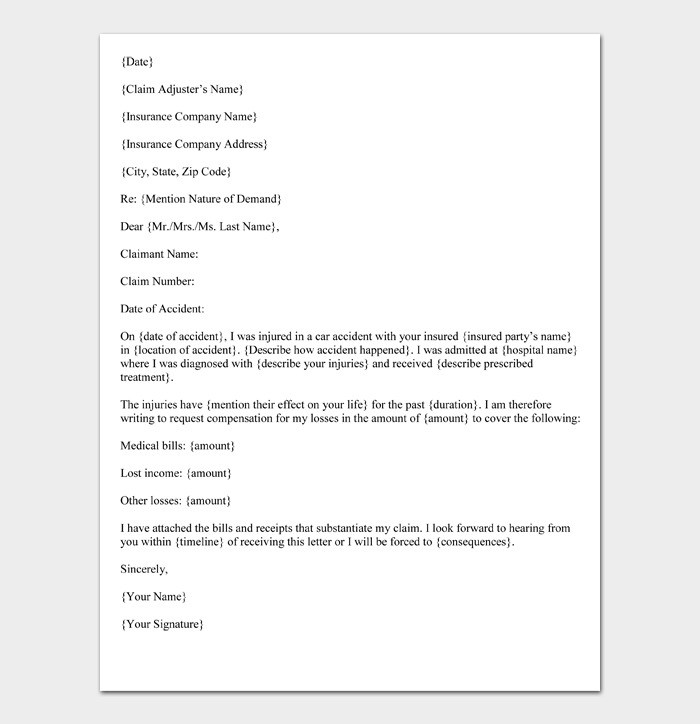

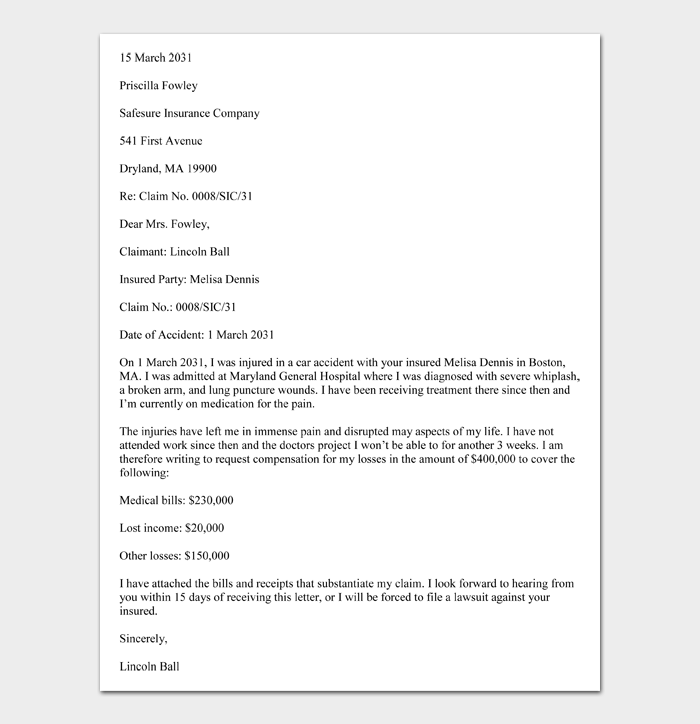

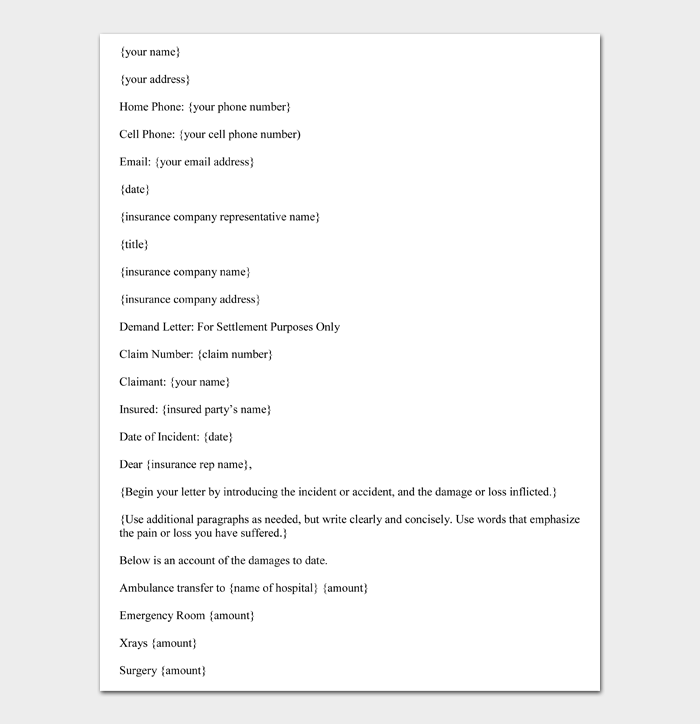

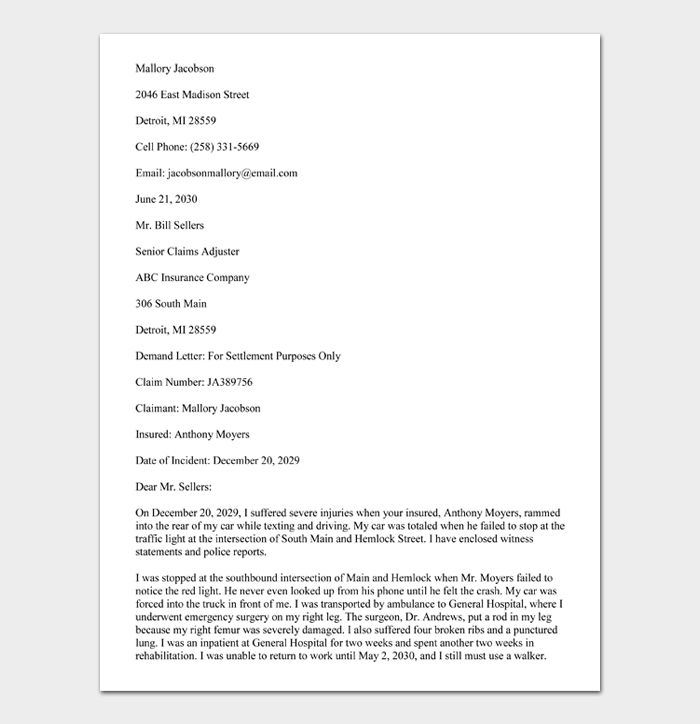

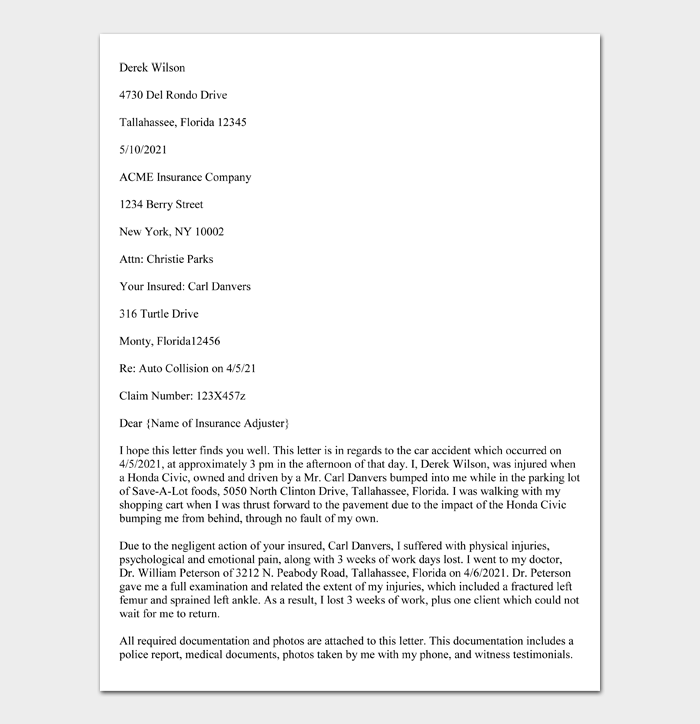

Car Accident Demand Letter

A car accident demand letter is a document written by the plaintiff in a personal injury case to request compensation. The sender is usually an individual who got hurt in a car accident, such as a driver, cyclist, pedestrian, or passenger, but could also be their representative.

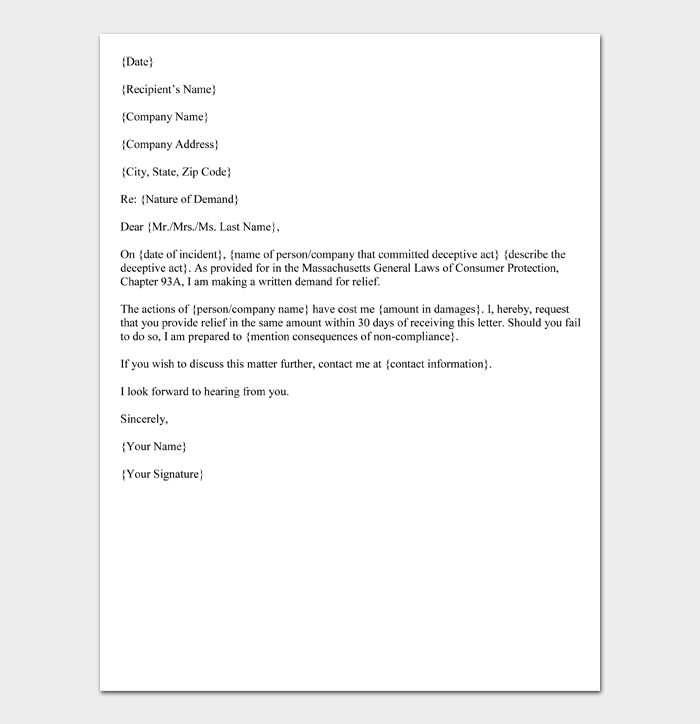

Chapter 93A (Massachusetts) Demand Letter

The Chapter 93A demand letter is an official document prepared before filing a lawsuit against a potential defendant for issues covered by the Massachusetts Consumer Protection Act. It describes why the sender is filing a lawsuit and the demands they have for the recipient. In most states, the recipient must respond to this letter within 30 days.

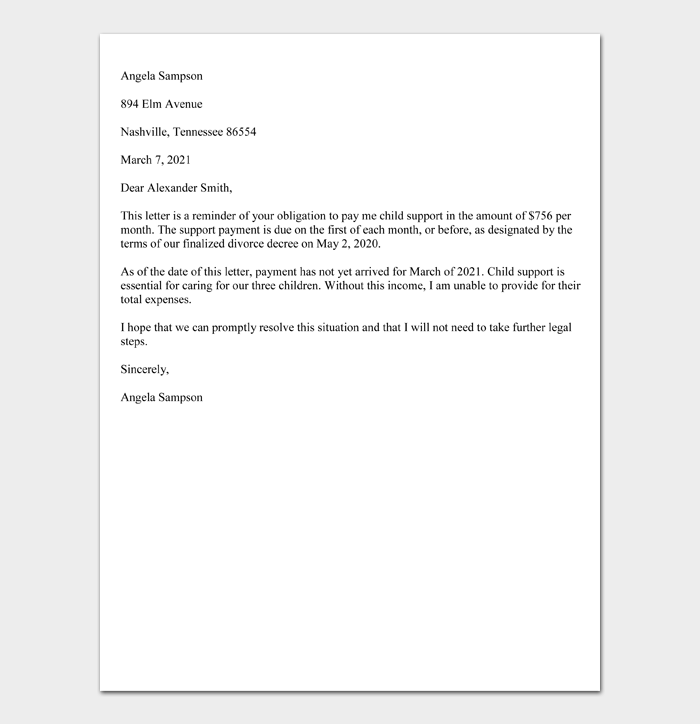

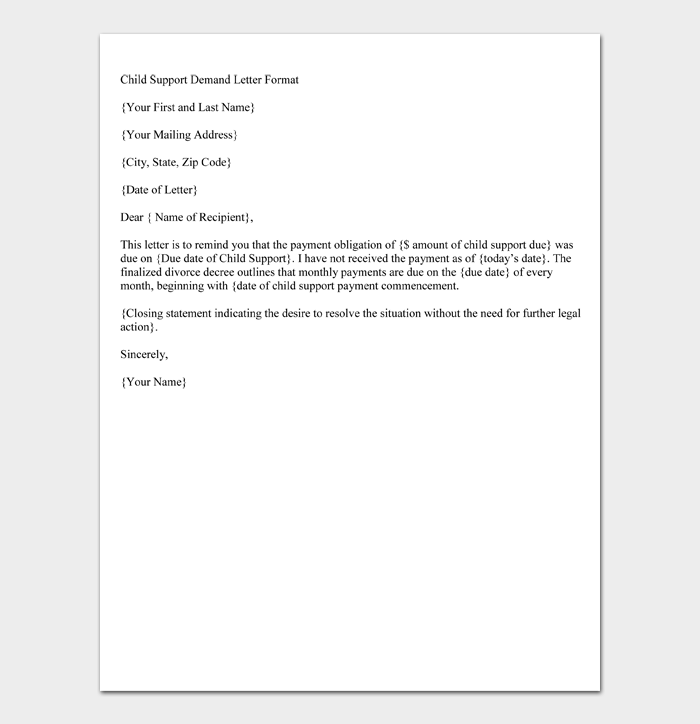

Child Support Demand Letter

A child support demand letter is a formal legal request sent to a parent who has defaulted or is behind on child support payments. It can be used as evidence in a lawsuit.

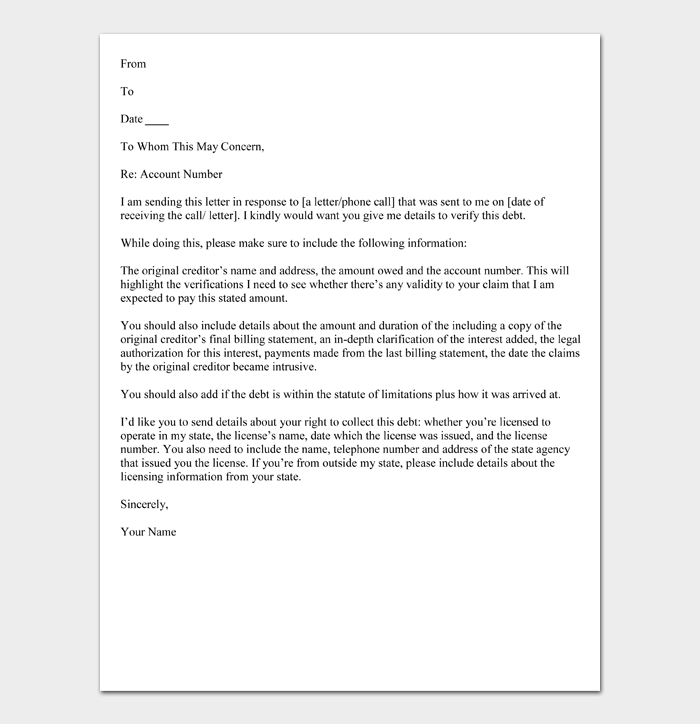

Debt Validation Letter

Consumers in the United States have the right to obtain information about a debt before committing to paying it. A debt validation letter allows you to practice that right by requesting that a collection agency or company verify a debt and provide evidence that you owe it.

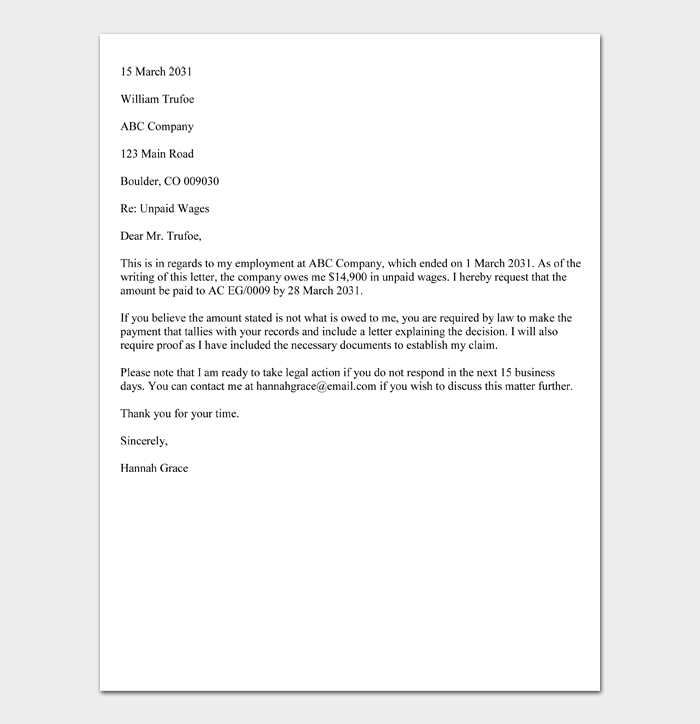

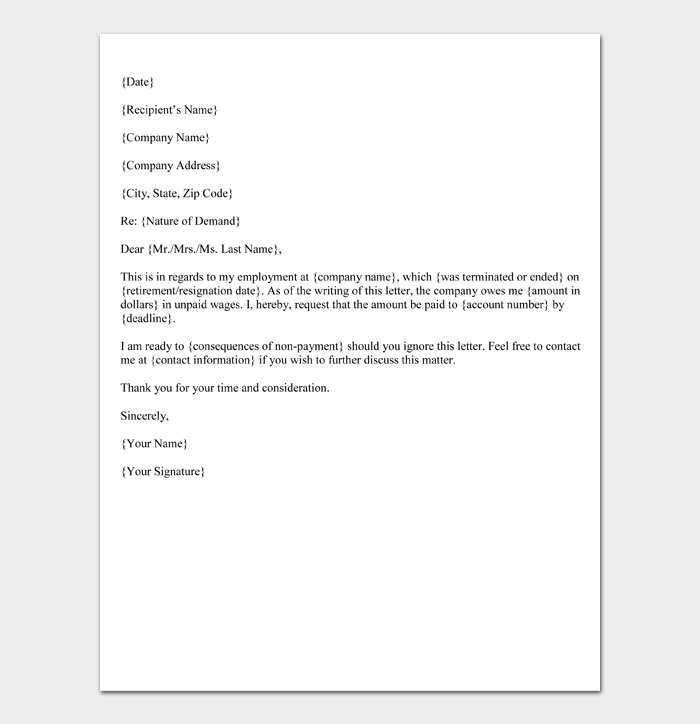

Unpaid Wages Demand Letter

An unpaid wages demand letter is a document prepared by an employee and sent to an employer to request the payment of overdue wages. It is commonly used in situations where the employee has resigned or retired and requires their last paycheck.

Insurance Company Demand Letter

An insurance company demand letter is an official document sent to an insurance company to request compensation for a covered disaster or accident. It is usually written by a policyholder or their representative notifying the insurer that they will be seeking financial reimbursement.

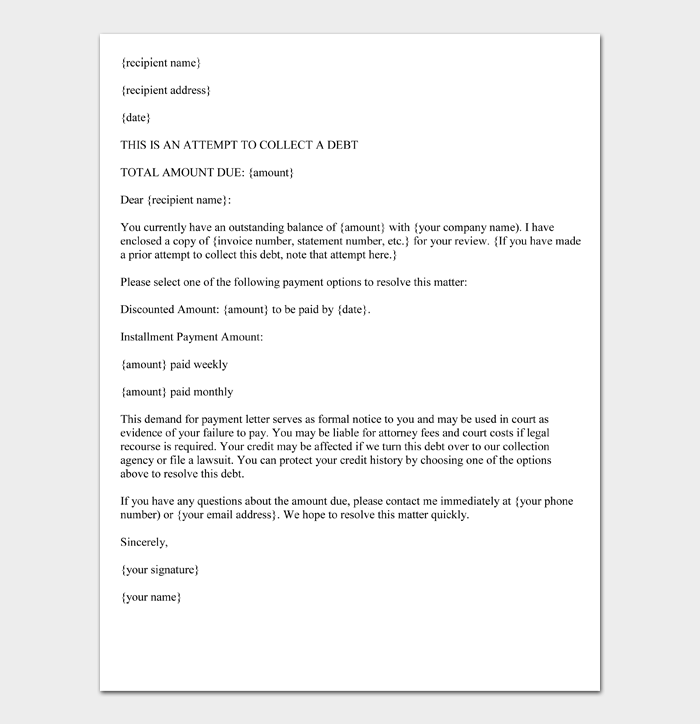

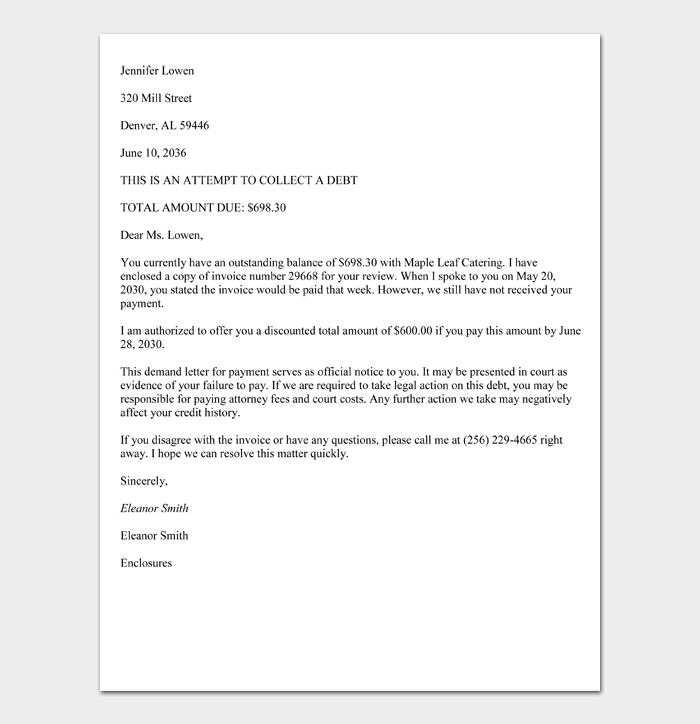

Demand Letter for Payment

A demand letter for payment is an official request for overdue payments, including loans, debts, or rent. It indicates the nature of the debt, the date it was incurred, a payment request, and the consequences of non-payment by a set date.

Personal Injury Demand Letter

A personal injury demand letter is an official document prepared and sent by a plaintiff or their representative requesting for compensation for their injuries.

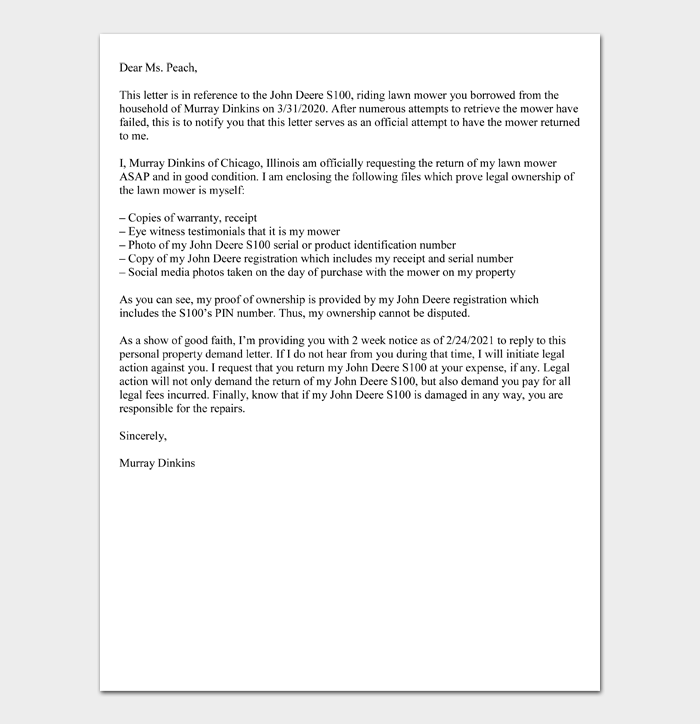

Personal Property Demand Letter

A personal property demand letter is an official request sent to an individual or company for items you own. It provides evidence of your ownership, explains why you are not currently in possession of the item, and asserts the action you are willing to take if your property is not returned.

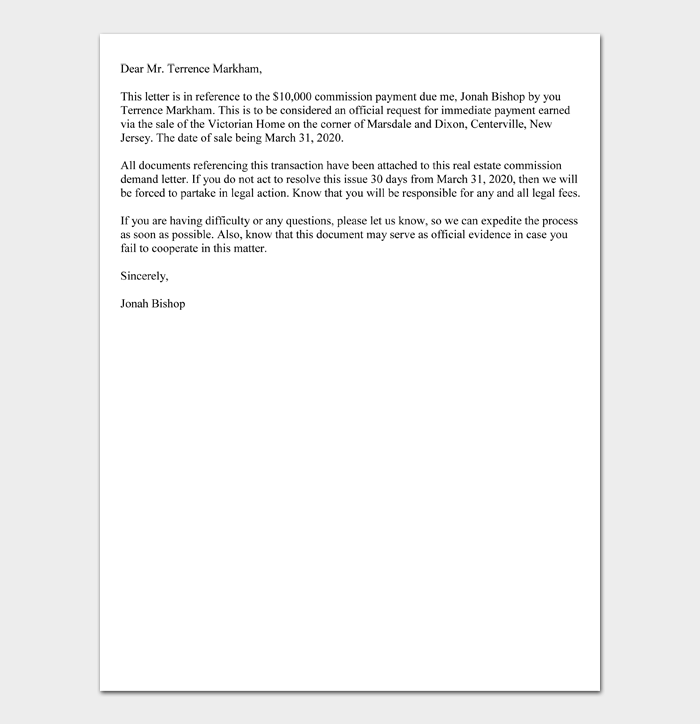

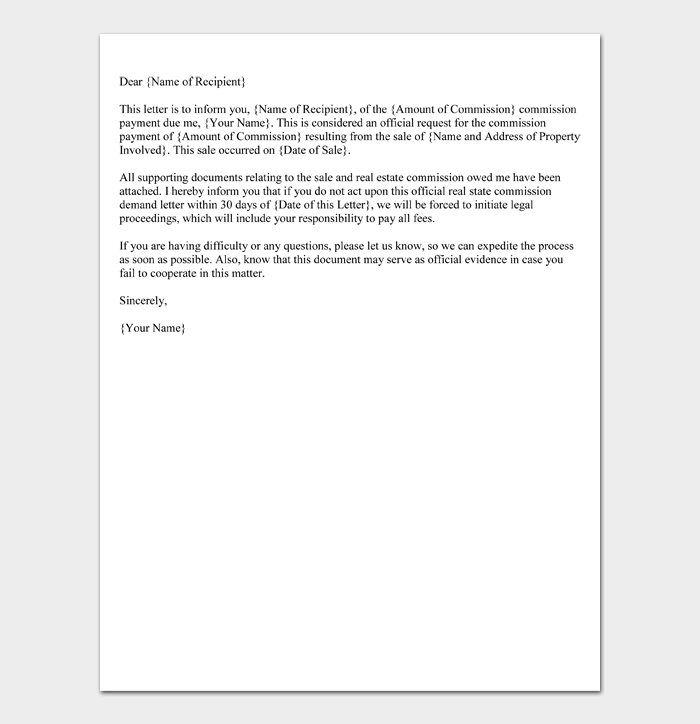

Real Estate Commission Demand Letter

A real estate commission demand letter is a document prepared by a broker and given to a client when the latter has not paid a due commission. It is usually sent following a transaction involving property, such as a sale or lease.

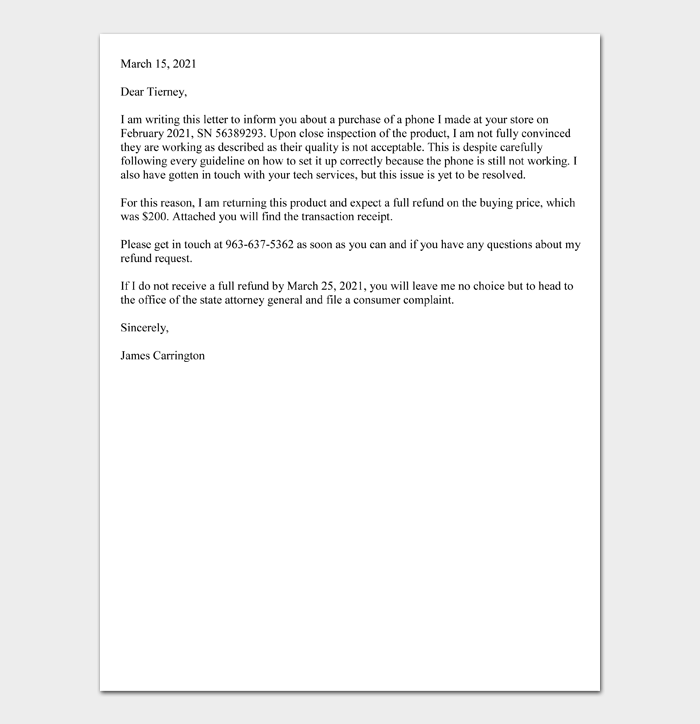

Refund Demand Letter

A refund demand letter is an official request sent by a consumer to a merchant for the return of payment on purchased goods or services. It includes basic information about the product, the reason the consumer is seeking a refund, and the expectations for payment.

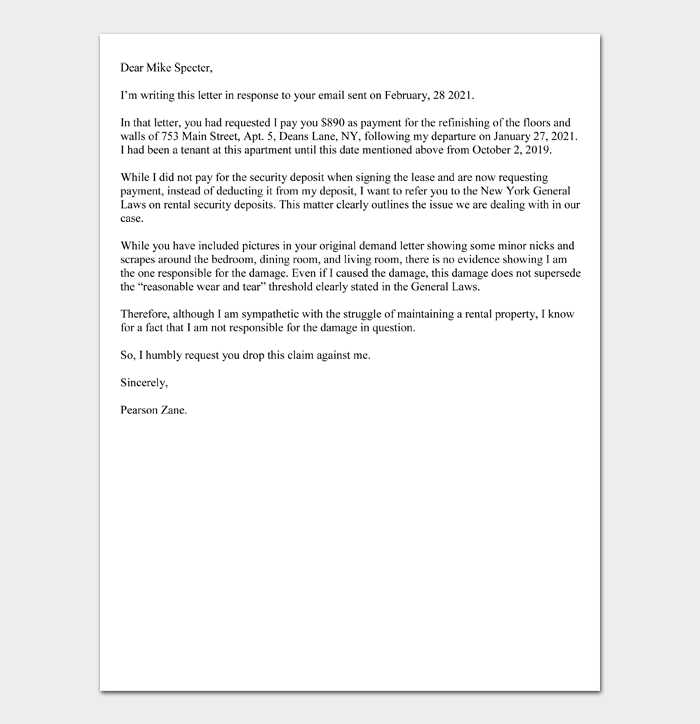

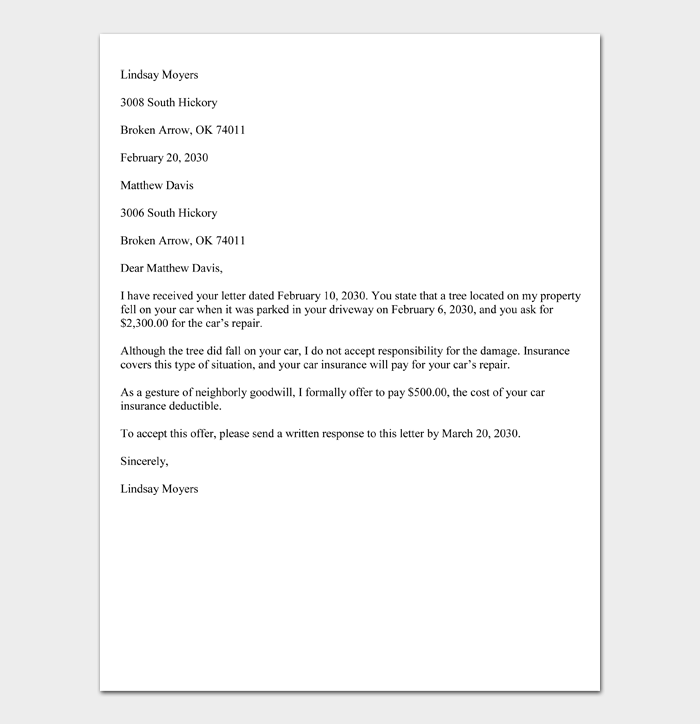

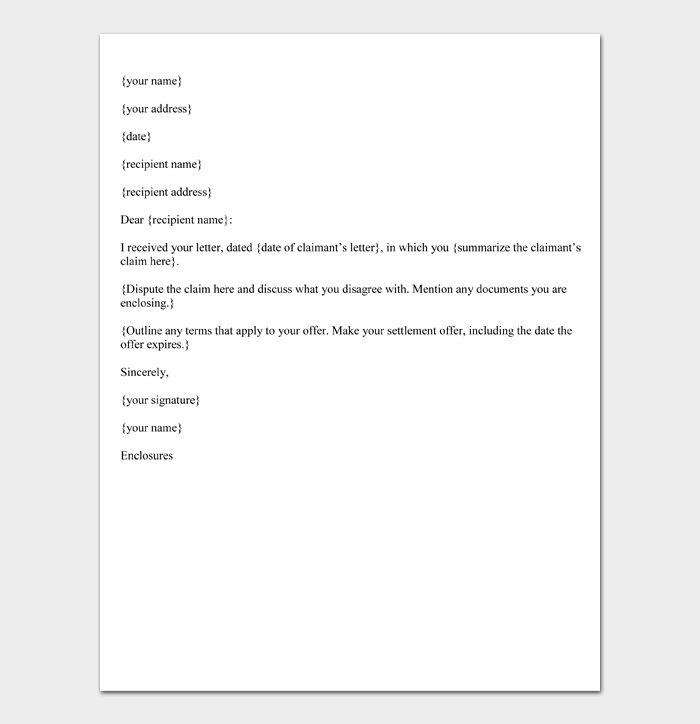

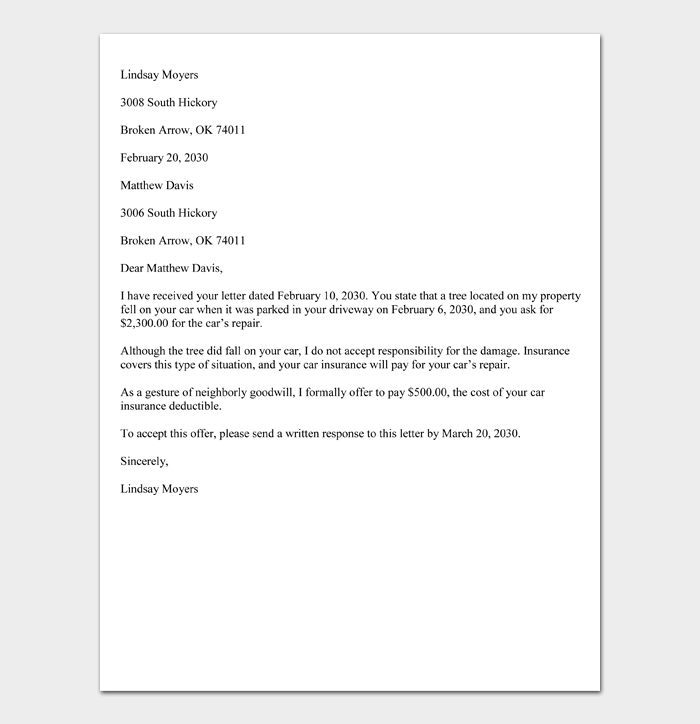

Response to Demand Letter

Response to the demand letter is an official reply to a demand letter for payment. It can be used to reject or dispute the demand for payment and can act as evidence in a lawsuit.

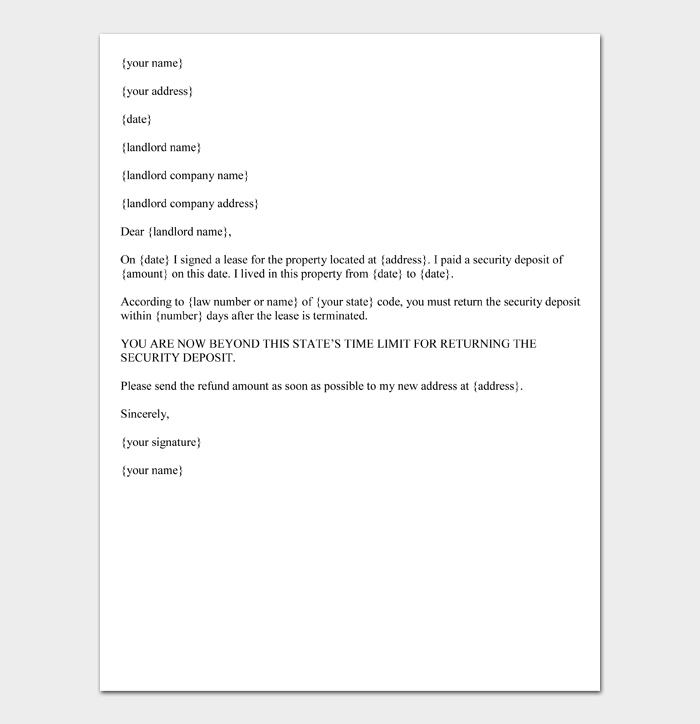

Security Deposit Demand Letter

A security deposit demand letter is a formal request sent by a tenant to a landlord for the repayment of the amount they paid at the beginning of the lease. The exact timeframe within which you can send this letter differs from state to state but often ranges between 14 and 60 days.

Settlement Demand Letter

A settlement demand letter is a document sent to a claimant to present a counteroffer to a previous payment request. It is commonly used in personal injury claims.

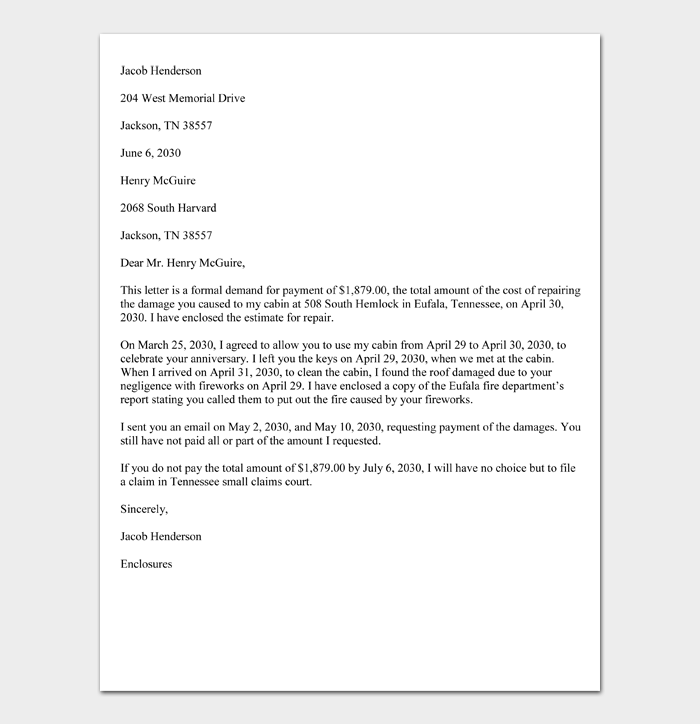

Small Claims Demand Letter

Small claims demand letter is a formal payment request sent to a debtor before the case is filed in a Small Claims court.

Tips for Writing a Demand Letter

Consider the following pointers when drafting your demand letter:

- Provide accurate information about the demand and provide supporting documents

- Avoid using aggressive or abusive language, even if you are angry about the delay

- Give an exact timeframe within which you would like to have reached a resolution

- Always authenticate the letter by adding your signature

- Mention all attached documents in your letter

- Send the letter via certified email and electronically to ensure it is delivered.

Demand Letter (FAQs)

A Demand Letter is a formal notice sent to an individual or company in an attempt to resolve a dispute. It can be used to ask that payment be made, or the recipient take another action due to an overdue debt, contract breach, or failure to meet an obligation. In many cases, a demand letter is sent before the aggrieved party turns to legal avenues for compensation.

If you have been injured in an auto accident, you may send a demand letter to the insurance company demanding a suitable settlement for your losses. Here are the steps to help you do this:

Step 1: Describe the Accident

Identify yourself by your full legal name, current address, and insurance policyholder number. Next, describe the accident in detail, indicating when, where, and how it happened. This is also the time to explain why another party was at fault for the accident, and you deserve compensation.

Step2: Describe Your Injuries

Go into detail about the physical, psychological, and emotional injuries you suffered as a result of the accident. You can even describe hobbies, events, and activities in which you can no longer participate due to your injuries. Overall, you want to be very objective and specific.

Step 2: Outline Any Property Damage

Mention whether the accident involved any damage to your property, ca, or items stored in your car. You can have your mechanic come up with a comprehensive report.

Step 3: Document All accident-related Expenses

Supply the losses you have described in steps 2 and 3 with monetary values. How much are your medical expenses? What is the value of the damage done to your car? Don’t leave out any cost, including transportation fees for trips to the doctor and lost income from not going to work.

Tip: When making your financial demand, present the insurance company with a reasonable figure that is not exact or lower than your losses and not too high that you seem greedy.

Step 4: Calculate Your Pain and Suffering

Finally, consult your attorney on the value of your pain and suffering, which will usually depend on the severity of your injuries. Attach all the relevant documents (receipts and medical records), then sign and date the demand letter.

The first step in an injury claim is usually to send a settlement demand letter to the at-fault party, their insurance company, or their attorney. Here is how to prepare this document:

Step 1: Describe the incident as you remember it, being as detailed as possible. Explain why the other party is responsible for the accident and avoid accepting blame.

Step 2: Describe your injuries and list all of them, even the most minor ones. Outline the medical treatments prescribed by your doctors to treat these injuries.

Step 3: Outline your damages, including the medical bills associated with your injury, lost income, lost earning ability, property damage, and pain and suffering.

Step 4: Stipulate your settlement demand. Try to indicate a realistic amount that is not too far above or below your losses. You also don’t want to give the exact figure as you won’t have room for negotiation.

Step 5: Attach related documents that prove your claim, including police reports, receipts, repair invoices, medical bills, medical reports, and letters from your employer.

Step 6: Supply your contact information, give the recipient a response timeline, and sign the document.

Your insurance claim will depend heavily on the content and factual quality of your insurance demand letter. These steps will help you draft this crucial letter:

Step 1: Clearly describe the facts of the case. Explain when, where, why, and how the incident happened, and why the other party was at fault. Mention police reports, video footage, and photographs that prove your claim.

Step 2: Describe your injuries, both minor and severe, and the medical treatments and expenses attached to them. Attach your medical reports, prescriptions, receipts, and hospital bills as proof. Additionally, describe other damages you suffered, such as lost income and emotional trauma.

Step 3: Provide an estimation of your economic and non-economic damages. Don’t indicate a too high demand that could be considered dishonest and greedy, and don’t undervalue your losses either, so you have enough room for negotiation.

When you receive a demand letter, contact your attorney, who will advise you to respond by:

• Agreeing to the demands in the letter and ending the dispute.

• Sending a letter stating that you refuse the sender’s demands and explaining why.

• Sending a letter disputing the sender’s claims, explaining why, and offering to settle the case out of court, i.e., through mediation and negotiation.

• Ignoring the letter. It is important to note that this could lead to you being taken to court.

If your claim goes to court, the judge will want to see proof of delivery of the demand letter. This is why this document should be sent via certified mail where possible. Other acceptable ways to send it to the recipient include:

• Hand delivery

• Sending via registered mail and requesting proof of delivery

• Hiring an attorney to deliver the letter

You should avoid sending your letter by text or email as these channels don’t offer proof of delivery. They also make it near impossible to verify crucial details such as the received date.

You can send a demand letter for a refund to a company or organization that fails to deliver products or services as advertised. Here are the steps:

Step 1: Review the company’s refund policy. If they don’t have one, look up what state laws say about your consumer rights and draft your letter as provided.

Note: Some companies have strict ‘not refund’ policies, but even these cannot be enforced if a company provides you with a dangerous or defective product.

Step 2: Attach documentation that proves the transaction happened. If you made the purchase using cash, attach the receipt. If you used a credit or debit card, collect a record from the account summary page on your bank’s portal.

Step 3: Explain your reason for demanding the refund, ensuring it is provided for in the refund policy. Be very clear about why the product is not as it was advertised.

Step 4: Make your refund demand and provide a specific dollar amount. Explain how and when you would like the money sent to you.

Step 5: If the company fails to refund you by the deadline set in step 4, consider taking one of the following actions:

• Discuss the matter with the local chamber of commerce or the Better Business Bureau (BBB).

• File a consumer complaint with the attorney general’s office.

• Write about your experience with the company in a review and post it online.

• File for damages in small claims court

You can send a demand letter for payment to someone who owes you money, and their dent is overdue. Here is how to do it:

Step 1: Describe the issue at hand so that someone that is unfamiliar with it can understand what happened. You should also mention all future attempts to collect the money.

Step 2: Mention any evidence (receipts, invoices, contracts, etc.) that prove your claim, including those in the recipient’s possession. Doing this will ensure they don’t get rid of the evidence.

Step 3: Make your demand and be very clear about what you want the recipient to do. Indicate an exact dollar amount, accounting for late fees where applicable, and a preferred mode of payment.

Step 4: Supply a deadline before which the recipient should pay the money owed. If the amount they owe you is large, consider allowing them to pay in installments.

Step 5: Explain the steps you plan to take if the recipient doesn’t meet your demand before the deadline. An acceptable option is filing a lawsuit but avoid threatening the recipient as you could end up facing a lawsuit.

There is no general answer to this question because demand letters are of various types and usually offer different deadlines. If your letter gives the recipient a timeline within which to meet your demands – say 7 days, 2 weeks, or 1 month, this is the period you should expect them to respond within. They might respond by asking for negotiation or extension, and the decision is at your discretion.

Yes, you can. Many people hire an attorney to draft a demand letter, especially when the matter involves money because they are more familiar with state laws. That said, there is no law against drafting your own demand letter, and you can do it if:

• The dispute is simple, and you believe you can handle it yourself.

• You plan to file a claim in a small claims court, where plaintiffs don’t need an attorney.

• You don’t want to use resources to pay an attorney.

• You can produce a detailed and well-organized demand letter.

When your attorney sends a demand letter, your only course of action is to wait for the recipient to respond. They may respond by settling the matter, making a counteroffer, or refusing to meet your demands. If the latter happens, you may file a lawsuit against them with the help of your attorney. If they make a counteroffer and you find it reasonable, you should consider negotiations.

Key Takeaways

A demand letter is an official (in some cases legal) document that can have legal uses, and as such, it should be written professionally and in a formal business format. After identifying yourself as the sender and acknowledging the reader, always get straight to the point and explain your reason for writing. It is crucial that you establish a timeline for your demand and provide the consequences of non-compliance. Finally, always authenticate your demand letter by closing with your full name, title, and handwritten signature.