A 30-day demand letter for payment is a formal notice sent to an individual or company that is in default of a debt to remind them that the payment is due. Once served upon the recipient, they have 30 days to cure the debt or face the consequences stipulated in the letter. Sending the letter allows you to take legal action against the recipient should they not respond within the allotted time.

After making several attempts to collect a debt to no avail, you may feel frustrated and out of options. This letter allows the debtor one more chance to cure their debt before you take legal action against them. Here is what you should know about drafting it.

What to Include in a 30-Day Demand Letter

The 30-day demand letter gives the debtor exactly 30 days from when they receive the letter to make payment. Make sure to include the following key information to avoid any back and forth that could eat into your timeframe:

- Your identity as the claimant – Your name, address, signature, and contact information

- A detailed account of the debt – Including amount, reason, interest rates, and previous collection attempts

- Damages you sustained due to the debt – Provide an itemized list and include supporting documents

- A description of the available relief options

- A timeline and deadline for the relief

- Consequences for non-compliance

Tips for Writing a 30-Day Demand Letter

Now that you know what to include in your 30-Day Demand Letter for Payment, here are some tips on how to draft your final copy:

- Always print your letter as handwritten messages may be ineligible

- Include your letterhead to make the letter formal

- Write in a polite, professional tone

- Explain the situation clear, without leaving room for misinterpretation

- Where applicable, mention and include supporting documents

- Make copies of the letter before sending it

How to Serve a 30-Day Demand Letter

Even the perfect demand letter is useless if it is not served on the debtor effectively. Consider the following pointers on delivering your message:

- Addresses – Always include the right and current addresses, of both the claimant and debtor. If you cannot find the debtor’s current address, call them first or visit their company.

- Certified Mail – While it is not a legal requirement, sending your letter via certified email will help you avoid any receipt or delay issues. It will also provide you with proof of delivery.

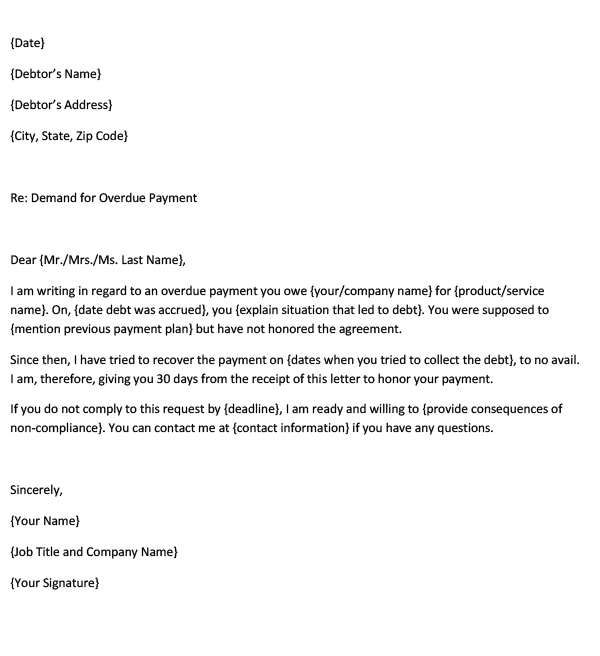

30-Day Demand Letter for Payment (Format)

{Date}

{Debtor’s Name}

{Debtor’s Address}

{City, State, Zip Code}

Re: Demand for Overdue Payment

Dear {Mr./Mrs./Ms. Last Name},

I am writing in regard to an overdue payment you owe {your/company name} for {product/service name}. On, {date debt was accrued}, you {explain situation that led to debt}. You were supposed to {mention previous payment plan} but have not honored the agreement.

Since then, I have tried to recover the payment on {dates when you tried to collect the debt}, to no avail. I am, therefore, giving you 30 days from the receipt of this letter to honor your payment.

If you do not comply to this request by {deadline}, I am ready and willing to {provide consequences of non-compliance}. You can contact me at {contact information} if you have any questions.

Sincerely,

{Your Name}

{Job Title and Company Name}

{Your Signature}

Sample – 30 Day Demand Letter for Payment

20 March 2031

Wendy Russel

009 Emery Road

Tallahassee, FL 99679

Re: Notice on Overdue Payment on Shipment

Dear Mrs. Russel,

This is in regard to the overdue payment you owe Whitkins Industries for the shipment of 3 bio-digesters, made on 24 December 2030. As per our agreement, you were supposed to have paid for our services by 13 January 2031, but have failed to do so.

Due to the delays and your failure to reply to our 2 collection attempts, your debt currently stands at $3,340. The extra $340 to the initial amount of $3,000 covers the interest rates accrued over time.

Consider this a request to make the payment within 30 days of receiving this letter. If you do not comply by 20 April 2031, we will be forced to file a lawsuit in court to recover our money.

You can contact us at whitkinsind.@email.com if you have any questions.

Sincerely,

Angel White

CFO, Whitkins Industries

30-Day Demand Letter for Payment (Word Template)

Key Takeaways

The 30-Day Demand Letter for Payment is a formal notice that carries serious repercussions. If the recipient fails to respond, you have the right to forward the debt to a collection agency or small claims court. This means that your letter should be up to code and should be written professionally. It is also crucial that you include all pertinent details about the debt, including dates and amounts.