The debt validation letter is a letter that verifies a debt by generating clear and valid evidence. This letter is usually written and sent by the consumer, being requested to settle an outstanding debt. You must send this letter within 30 days after receiving a notice of collection attempt. All consumers have the right to know how the debt came into existence via the Fair Debt Collection Practices Act.

If you’re a resident in the USA, you must complete information about your debt according to the law, as this is part of your rights. As a debtor, you are also supposed to respond to the letter within 30 days of receiving the demand payment letter.

Steps To Send a Debt Validation Letter

There are a couple of steps you should follow when writing the debt validation letter and this are;

Step 1 – Write A Debt Validation Letter

In this letter, you should ask the creditor to give you their address and name to justify for the debt. As you write this letter, you must try never to sound defensive.

Step 2 – Include A Cease And Desist Addendum

While this is optional, it does help in informing the agency that you are aware of the debt and don’t need to be reminded. Should the creditor persist with this habit, let them know they’re leaving you no choice but to take legal action against them.

Step 3 – Sign The Documents

For this letter to be legally served to the creditor, it should only be sent via the USA Postal Service alongside a return receipt. After receiving the validation letter, the creditor proceeds to sign its receipt and then sending it back to the debtor.

Step 4 – Send The Letter And Wait For 30 Days

According to the U.S.’s federal law, specifically 15 U.S. Code & 1692g(b), creditors are given 30 days to carry out their investigation and then contact the debtors with their findings.

Note: In case the creditor doesn’t get in touch within 30 days, then then debt collection is considered invalid.

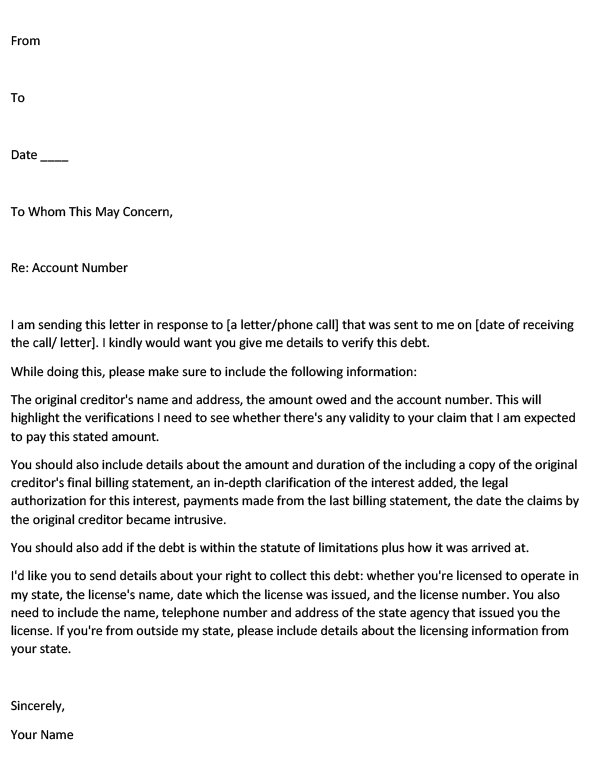

Sample – Debt Validation Letter

From

To

Date ____

To Whom This May Concern,

Re: Account Number

I am sending this letter in response to [a letter/phone call] that was sent to me on [date of receiving the call/ letter]. I kindly would want you give me details to verify this debt.

While doing this, please make sure to include the following information:

The original creditor’s name and address, the amount owed and the account number. This will highlight the verifications I need to see whether there’s any validity to your claim that I am expected to pay this stated amount.

You should also include details about the amount and duration of the including a copy of the original creditor’s final billing statement, an in-depth clarification of the interest added, the legal authorization for this interest, payments made from the last billing statement, the date the claims by the original creditor became intrusive.

You should also add if the debt is within the statute of limitations plus how it was arrived at.

I’d like you to send details about your right to collect this debt: whether you’re licensed to operate in my state, the license’s name, date which the license was issued, and the license number. You also need to include the name, telephone number and address of the state agency that issued you the license. If you’re from outside my state, please include details about the licensing information from your state.

Sincerely,

Your Name

Debt Validation Letter (Template)

How to Write a Validation Letter?

Follow the steps below to write your validation letter:

Step 1- Get The Letter Template

Having a letter template enables you to go through the paperwork easily. After reviewing, you need to find out whether the software you are using is remarkable for fill your entire information to either word processing document or even PDF. In case it is suitable, you can dial either of them in the caption area by using their representation buttons. Ensure that you only fill your part on this form since it involves multiple parties.

Step 2- Complete The Heading With The Appropriate Information

There is essential information on the first page of the paperwork you receive. It should only be filled by an individual who is a respondent to an entity trial of debt collection that she or he is familiar with. However, if you are a sender, you must be sure about the date the paperwork will be sent through documentation. Put this in writing at the top of your right-hand end on the blank line. On the other hand, on the same page, there are three blank lines on the left-hand side. Indicate the recipient’s correct name on the first line, and on the following two lines indicate the recipient’s legal email. Just before the body, write the name given by the entity you are working on. You can also use the department name on the paperwork.

Step 3- Explain The Purpose Of Your Letter

When you open your letter, there are two checkboxes under it. On that space, indicate why you are sending the paperwork to the person you are addressing. It might be because of the mistakes in the bill you just received, among many more reasons. Bear in mind that all these must be done in the two checkboxes. For error, use the second checkboxes.

Step 4- Sign This Letter As Well As The Cease And Desist Notice

After shortlisting your reasons, you need to make it official by putting in your signature. This will show the seriousness of your letter. At the bottom of your page, ensure that you sign under the word sincerely. Emulate the same on the second page.

Step 5- Creditor Must Provide The Requested Information

The third page is also referred to as the debtor/ creditor declaration, and the receiver is the only person who should fill this page. This page features a lot of information. You must understand that the creditor is the person seeking the payment of the debt. Therefore, the legal name on the first line of this page must be that of the creditor. The second line should feature the alleged name of the debtor, disclosed by the creditor in the same way it appears on the paperwork. After that, there is an alleged account, which is for the debtor’s account number and the creditor seeking for his or her payment. This is followed by the amount the debtor owes the creditor, referred to as the alleged debt. On the blank line indicated date, the creditor should write when to receive payment from the debtor.

Step 6- Ensure A Formal Request For Information Is Met By The Creditor

The final page of the paperwork requires sufficient information from the creditor, which he or she should compose easily. The creditor should also be able to answer some information on this page.

Conclusion

It’s important to know that not every debt collector is honest about you having an outstanding debt with them. And should a creditor get in touch with you demanding payment of the outstanding debt that you don’t know about, writing a debt validation letter is advised. This way, you’ll get the needed confirmation whether really the debt payment request is valid or someone is trying to swindle your hard-earned money.