A demand letter for payment is a formal document written with the intent of collecting a debt. Businesses frequently use demand letters for payment when a customer or client does not pay on time. This letter reminds the debtor of the amount owed and sets a payment deadline.

In this article, we discuss the difference between an invoice and a demand letter for payment. We also provide a checklist of what to include in your demand letter. You will find a format for a demand letter for payment and a sample letter below.

Demand Letter for Payment: By Type (5)

Invoice Vs. Demand Letter for Payment

Your accounts receivable department uses several specialized documents to manage customer and client accounts. Demand letters and invoices are two of these documents. Below are the primary qualities of invoices and demand letters for payment.

- Invoice: An invoice is a professional document that details a customer’s debt and requests payment. Invoices usually have a detailed line for each item purchased. The total due is found at the end of the document. Invoices inform the customer of their purchases, the amount owed, and the due date.

- Demand letter for payment: A demand letter for payment is a professional document that contains the total amount due and the payment deadline. This letter reminds the customer that they did not pay an invoice by the due date. Demand letters inform the customer of the amount owed and the consequence of not paying the past-due balance by the payment deadline.

What to Include in Your Demand Letter for Payment

- Date

- Amount due

- Debt information (invoice number or contract number) This information is evidence of the debt. Attach a copy to your letter.

- Any prior attempts to collect the debt (phone calls, emails, etc.)

- Payment deadline

- Consequences of non-payment (legal action, collection agency, etc.)

- Payment options

Demand letters may include several options for payment. For example, the customer may have the option of paying the total amount due or making installment payments.

Note: In some situations, the writer may offer a discounted amount or a settlement offer to settle the debt. In this case, the writer should mention if the discount (settlement offer) is only valid until a specific time.

Send your demand letter via certified mail with a return receipt requested. Also, be sure to keep a copy of your letter and evidence of the debt. These documents provide valuable evidence of your attempt to collect if you must take legal action to recover the debt.

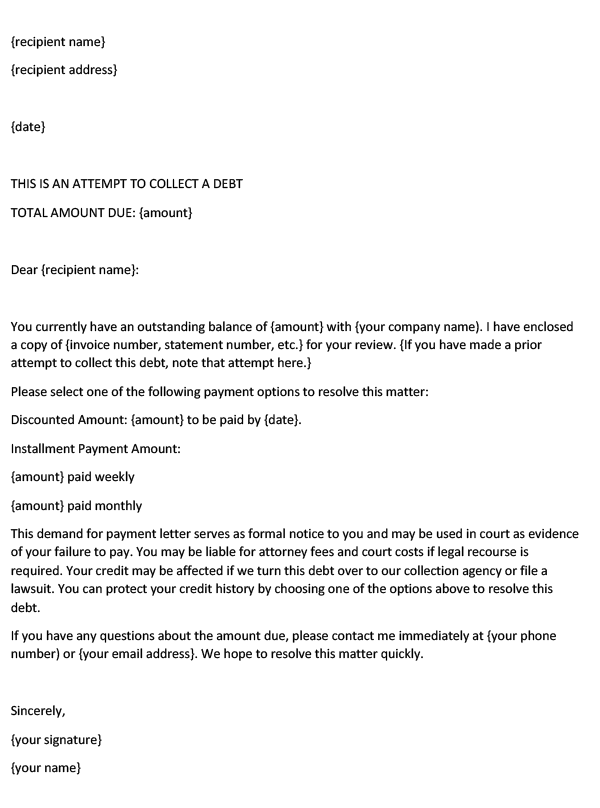

Format – Demand Letter for Payment

Re: Outstanding Payment Notice

Dear [Recipient Name],

I am writing to bring to your attention an outstanding payment associated with your account. As of the date of this letter, our records indicate that you have an unpaid balance of [Amount] with [Your Company Name]. For your ease of reference, I have attached a copy of [Invoice Number, Statement Number, etc.].

If you recall, we have previously made an attempt to notify you of this outstanding payment and thus far, the payment has not been received or resolved.

To facilitate the settlement of this outstanding balance, we are providing you with the following options:

1. Pay a discounted amount of [Discounted Amount] by [Date]. This option allows you to resolve your account with a one-time payment, saving you from the total amount due.

2. Opt for an installment payment plan, which can be arranged as follows:

– Weekly installment of [Weekly Amount]

– Monthly installment of [Monthly Amount]

Please understand that this letter serves as a formal demand for payment and is intended to signify the seriousness of the situation. If this matter escalates to a court proceeding, this letter may be used as evidence of your default. In such a scenario, you may be held responsible for attorney fees and court costs.

Additionally, it is crucial to note that failure to settle this debt may affect your credit standing. We may have to involve our collection agency or take legal action, which will likely negatively impact your credit history. Therefore, we earnestly recommend choosing one of the above options to resolve this outstanding payment.

Should you have any questions or require further clarification about the amount due or payment options, please do not hesitate to reach out to me at [Your Phone Number] or [Your Email Address]. We are more than willing to assist you and hope to resolve this matter promptly.

Thank you for your immediate attention to this matter.

Yours sincerely,

[Your Name][Your Signature]Sample Demand Letter for Payment

Jennifer Lowen

320 Mill Street

Denver, AL 59446

June 10, 2036

THIS IS AN ATTEMPT TO COLLECT A DEBT

TOTAL AMOUNT DUE: $698.30

Dear Ms. Lowen,

You currently have an outstanding balance of $698.30 with Maple Leaf Catering. I have enclosed a copy of invoice number 29668 for your review. When I spoke to you on May 20, 2030, you stated the invoice would be paid that week. However, we still have not received your payment.

I am authorized to offer you a discounted total amount of $600.00 if you pay this amount by June 28, 2030.

This demand letter for payment serves as official notice to you. It may be presented in court as evidence of your failure to pay. If we are required to take legal action on this debt, you may be responsible for paying attorney fees and court costs. Any further action we take may negatively affect your credit history.

If you disagree with the invoice or have any questions, please call me at (256) 229-4665 right away. I hope we can resolve this matter quickly.

Sincerely,

Eleanor Smith

Eleanor Smith

Enclosures

Demand Letter for Payment (Word Template)

Fun Fact: Did you know that demand letters for payment are often far more cost-effective than immediately resorting to legal action? This is because initiating a lawsuit can be expensive and time-consuming. Demand letters, however, provide a formal yet relatively inexpensive method to negotiate and resolve disputes. It’s also noteworthy that the majority of disputes are actually resolved after the sending of a demand letter and before any lawsuit is filed. This can be attributed to the fact that demand letters often encourage the debtor to pay, as they elucidate the seriousness of the situation and potential consequences, like credit damage or legal action.

Key Points:

- Remind the debtor of the debt

- Enclose invoice or statement copies as proof of the debt

- Set a payment deadline

- Offer several payment options when possible

- Provide the consequence of non-payment