A demand letter to insurance company for property damage is an official document presented to an insurance company when you are seeking compensation for damage to your insured property. You, as the claimant or the person writing the letter, must inform the insurance company of how your property was damaged, the value of your losses, and the amount you are seeking in compensation.

Property can get damages through many events, including fires, theft, and floods. If you have insured your property against any of these and they happen, you can use this letter to begin negotiations with your insurer about financial reimbursement.

What to Include in Your Letter to Insurance Company

Because your demand letter is the foundation of your insurance claim process, it should be as detailed as possible. It should include the following key information:

- Your identity, which includes your insured name, insurance policy type and number, and insured period.

- A clear description of the circumstances of the case. You can create this portion of your letter by answering the questions who, when, what, where, and why.

- The total value of your loss, including supporting evidence

- Other damages you may have suffered due to the accident

- A dollar value that covers all your losses

Relevant Attachments for Your Demand Letter

The insurance company will want to go on more than your word alone, and as so, you should attach the following documents to your letter, where necessary:

- A police report

- Witness statements

- Receipts for all property repairs

- Pictures of the damage

Tips for Writing a Demand Letter to Insurance Company

Your entire insurance claim will depend on your Demand Letter to Insurance Company for Property Damage. Consider the following pointers when drafting it:

- Be factual – Never include anything in your letter that cannot be backed up with facts. When unsure about facts and figures, use terms like ‘about’ or ‘approximately.

- Never accept liability – Even if you feel you may have been a tad careless, never give the insurance company a reason to deny your claim.

- Use language to shift things in your favor – This does not mean that you should exaggerate, rather use terms that illustrate the seriousness of the matter.

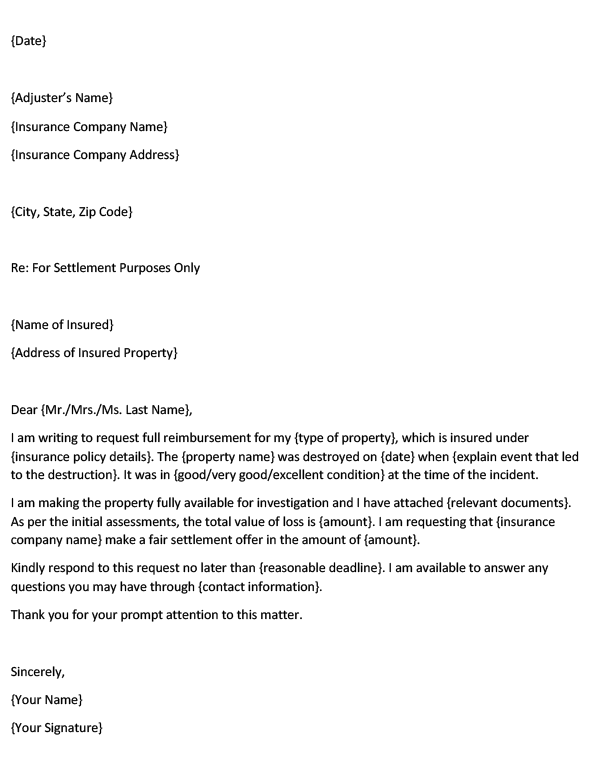

Format – Insurance Company Demand Letter

{Date}

{Adjuster’s Name}

{Insurance Company Name}

{Insurance Company Address}

{City, State, Zip Code}

Re: For Settlement Purposes Only

{Name of Insured}

{Address of Insured Property}

Dear {Mr./Mrs./Ms. Last Name},

I am writing to request full reimbursement for my {type of property}, which is insured under {insurance policy details}. The {property name} was destroyed on {date} when {explain event that led to the destruction}. It was in {good/very good/excellent condition} at the time of the incident.

I am making the property fully available for investigation and I have attached {relevant documents}. As per the initial assessments, the total value of loss is {amount}. I am requesting that {insurance company name} make a fair settlement offer in the amount of {amount}.

Kindly respond to this request no later than {reasonable deadline}. I am available to answer any questions you may have through {contact information}.

Thank you for your prompt attention to this matter.

Sincerely,

{Your Name}

{Your Signature}

Sample – Insurance Company Demand Letter for Property Damage

6 April 2031

Denis Johnson

Life Insurance Company

100 Indiana Road

Jackson, MI 88900

Re: For Settlement Purposes Only

Insured: Patricia Watkins

Insured Property Address: 127 Rose Field, Jackson, MI

Dear Mr. Johnson,

I am writing to request full reimbursement for my house on 127 Rose Field, Jackson, MI which is insured under Policy ID 009/LIC, Insurance Against Natural Disasters. The house was destroyed on 2 April 2031 during the earthquake that hit Jackson. It was in excellent condition at the time of the incident.

I am making the property fully available for investigation and I have attached pictures of the damage, as taken by professional assessors. The initial calculations show that the total value of loss stands at $320,000. I am requesting that you make a fair settlement offer in this amount.

Kindly respond to this request no later than 15 April 2031. I am available to answer any questions you may have through patriciawatkins@email.com.

Thank you for your prompt attention to this matter.

Sincerely,

Patricia Watkins

Claim Letter to Insurance Company (Template)

Key Takeaways

Besides being a factual summary of your property damage claim, a demand letter to insurance company for property damage should list all the losses you suffered after the event.