Insurance company demand letters are formal documents in which a claimant demands money from an insurance company. You write an insurance company demand letter when you need to make a claim on your insurance or another person’s insurance. Your letter outlines the incident that caused your loss and demands payment to cover it. There are different types of insurance company demand letters.

This article discusses these two types and what you should include in your insurance company demand letter. We also provide a format you can use when you write your letter and a sample letter for you to read.

Two Types of Insurance Company Demand Letters

You can write an insurance company demand letter when you suffer a loss due to another person’s negligence. For example, if you are injured in a car accident, you can write an insurance company demand letter to the insured’s insurance company. You are the claimant in this case, and the person who caused the accident is the insured. In this letter, you discuss what the insured did to cause your loss and provide a detailed account of your financial loss. You can only ask the insurance to pay after you have recovered from the injury.

You can write another type of insurance company demand letter when you suffer a loss due to theft, fire, or a weather-related disaster. In this case, you are both the claimant and the insured. You write this letter to your insurance company asking for payment for your loss. This letter details the incident that caused your loss and provides an itemized list of your losses, as well as the total amount demanded.

Often, you have already filed a claim with the insurance company, and this letter is a follow-up document that includes all the information the insurance company needs to pay on your claim. Write your letter to the insurance company representative who helped you file your claim or the insurance claim adjuster.

What to Include In Your Letter to the Insurance Company

- Claim number

- Claimant name (your name)

- Insured name (your name if you are the insured; otherwise, the party responsible for your loss)

- Your contact information

- Date

- Date of incident

- A detailed account of the incident responsible for your loss

- A detailed, itemized account of your loss

- The total amount you are demanding (Ask for more than you expect to get to leave room for negotiation.)

- A reference to enclosed documents

- A deadline for response

- Your signature

Tip: If the insurance company does not pay the amount you negotiate with them, hire an attorney. The attorney can help you navigate the legal process that might help you recover your financial loss.

You can use the following format to help you write your letter. Add or remove items to personalize your letter. Enclose any documentation you have, such as a police report, a lost wages statement from your employer, or medical bills.

Insurance Company Demand Letter Format

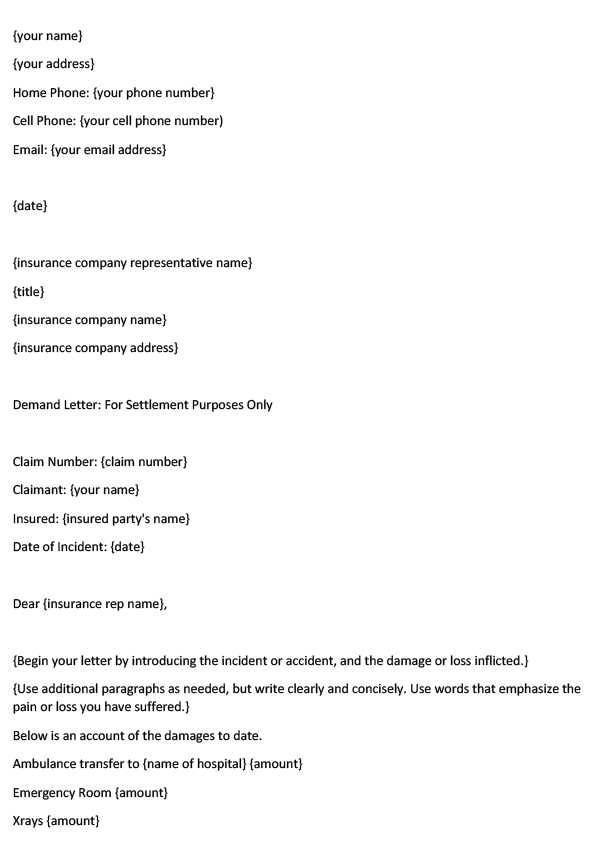

{your name}

{your address}

Home Phone: {your phone number}

Cell Phone: {your cell phone number)

Email: {your email address}

{date}

{insurance company representative name}

{title}

{insurance company name}

{insurance company address}

Demand Letter: For Settlement Purposes Only

Claim Number: {claim number}

Claimant: {your name}

Insured: {insured party’s name}

Date of Incident: {date}

Dear {insurance rep name},

{Begin your letter by introducing the incident or accident, and the damage or loss inflicted.}

{Use additional paragraphs as needed, but write clearly and concisely. Use words that emphasize the pain or loss you have suffered.}

Below is an account of the damages to date.

Ambulance transfer to {name of hospital} {amount}

Emergency Room {amount}

Xrays {amount}

Surgery {amount}

Prescriptions {amount}

Physical Therapy {amount}

Mental Therapy {amount}

Emotional Distress {amount}

Pain and Suffering {amount}

Total Damages {amount}

{Use this space to inform the insurance company that their insured was clearly responsible for the loss.} Please respond to this letter within 30 days of the date on the letter.

Thank you for your time and consideration of the above claim. If you have any questions, please feel free to contact me.

Cordially,

{your signature}

{your name}

Enclosures

Sample Insurance Company Demand Letter

Mallory Jacobson

2046 East Madison Street

Detroit, MI 28559

Cell Phone: (258) 331-5669

Email: jacobsonmallory@email.com

June 21, 2030

Mr. Bill Sellers

Senior Claims Adjuster

ABC Insurance Company

306 South Main

Detroit, MI 28559

Demand Letter: For Settlement Purposes Only

Claim Number: JA389756

Claimant: Mallory Jacobson

Insured: Anthony Moyers

Date of Incident: December 20, 2029

Dear Mr. Sellers:

On December 20, 2029, I suffered severe injuries when your insured, Anthony Moyers, rammed into the rear of my car while texting and driving. My car was totaled when he failed to stop at the traffic light at the intersection of South Main and Hemlock Street. I have enclosed witness statements and police reports.

I was stopped at the southbound intersection of Main and Hemlock when Mr. Moyers failed to notice the red light. He never even looked up from his phone until he felt the crash. My car was forced into the truck in front of me. I was transported by ambulance to General Hospital, where I underwent emergency surgery on my right leg. The surgeon, Dr. Andrews, put a rod in my leg because my right femur was severely damaged. I also suffered four broken ribs and a punctured lung. I was an inpatient at General Hospital for two weeks and spent another two weeks in rehabilitation. I was unable to return to work until May 2, 2030, and I still must use a walker.

Below is an account of the damages to date. Documentation enclosed.

Ambulance transfer to General Hospital $1,200.00

Emergency Room $2,300.00

Xrays $600.98

Surgery $2,800.00

Prescriptions $540.24

Rehabilitation Care (two weeks) $3,460.00

Hospital Care (two weeks) $4,500.68

Physical Therapy $2,800.00

Pain and Suffering $100,000.00

Total Damages $118,201.90

Your insured was cited by Detroit authorities for reckless driving and driving while texting, as well as negligence causing an accident. Mr. Moyers is clearly liable for my injuries and losses. I hereby demand a total of $118,201.90 for my injuries, pain, and suffering due to the accident your insured caused. Please respond to this demand letter within 30 days of the postmarked date.

Thank you for your time and consideration of the above claim. If you have any questions, please feel free to contact me.

Cordially,

Mallory Jacobson

Mallory Jacobson

Enclosures

Insurance Company Demand Letter (Word Template)

Key Points:

- Write your letter in a professional format and tone

- Write a detailed account of the incident that caused your loss

- Provide a detailed, itemized list of the loss

- Demand the total amount

- Provide a deadline for response